How Technology, Demographics, Climate, and Geopolitics Are Rewriting the Investment Playbook

Summary

- Four interconnected megatrends-4th Industrial Revolution technology, aging demographics, climate change, and a multipolar world-are fundamentally transforming the global investment landscape.

- These forces are shifting trillions of dollars in capital, creating both risks and opportunities for investors who must adapt to rapid technological change, demographic shifts, environmental imperatives, and geopolitical fragmentation.

- The Fourth Industrial Revolution is driving productivity and new business models through AI, robotics, and data, while also disrupting labor markets and requiring ongoing workforce reskilling.

- Aging populations are increasing demand for healthcare, senior living, and income-producing assets, but also pose challenges for economic growth and public finances.

- Successful investing in this new era requires thematic diversification, active risk management, and the ability to “follow the money” by identifying where major capital flows are heading across these megatrends.

The global investment landscape is undergoing unprecedented transformation, driven by four interconnected secular forces. These trends are reshaping industries, economies, and societies, creating both challenges and opportunities for investors:

- 4th Industrial Revolution Technology

- Aging Demographics

- Climate Change

- A Multipolar World

These secular megatrends are driving the shift of trillions of dollars in investments from private enterprise, government and investors. Understanding the risks and opportunities is key to not only sustaining in an era of massive global change, but having a chance to thrive in it.

To make the most money and manage your risk, you need to ignore ideology and invest where the big money is moving into. In short, “follow the money” to be a good investor.

The global investment landscape is being reshaped so powerfully, it is necessary for investors to engage in ongoing examination in order to find actionable insights and data-driven strategies to navigate this complex environment. Here are summaries of each megatrend.

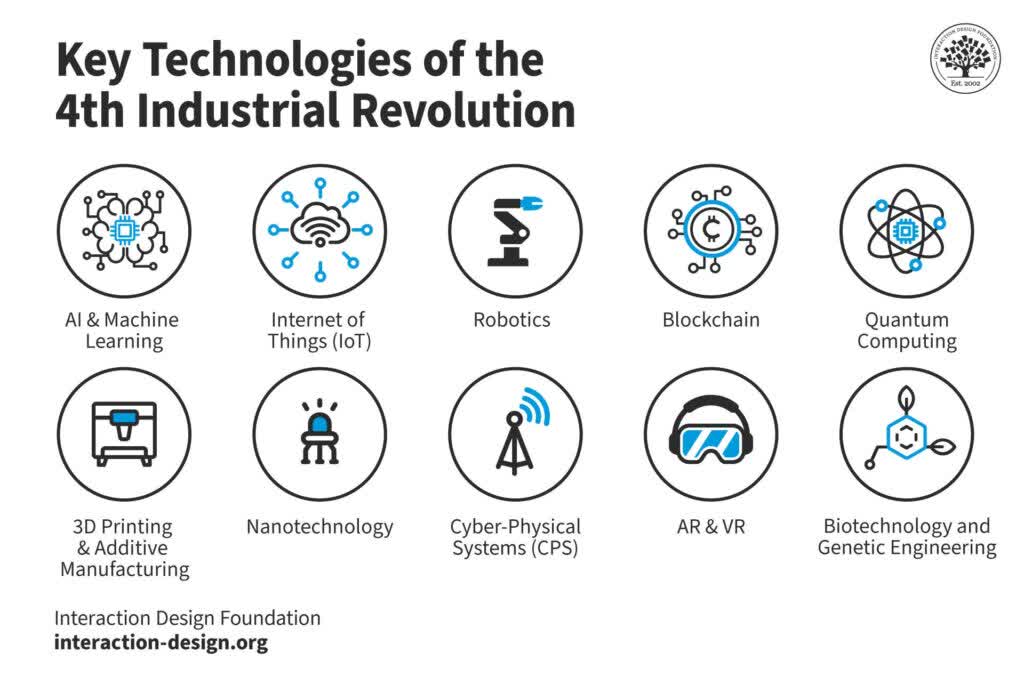

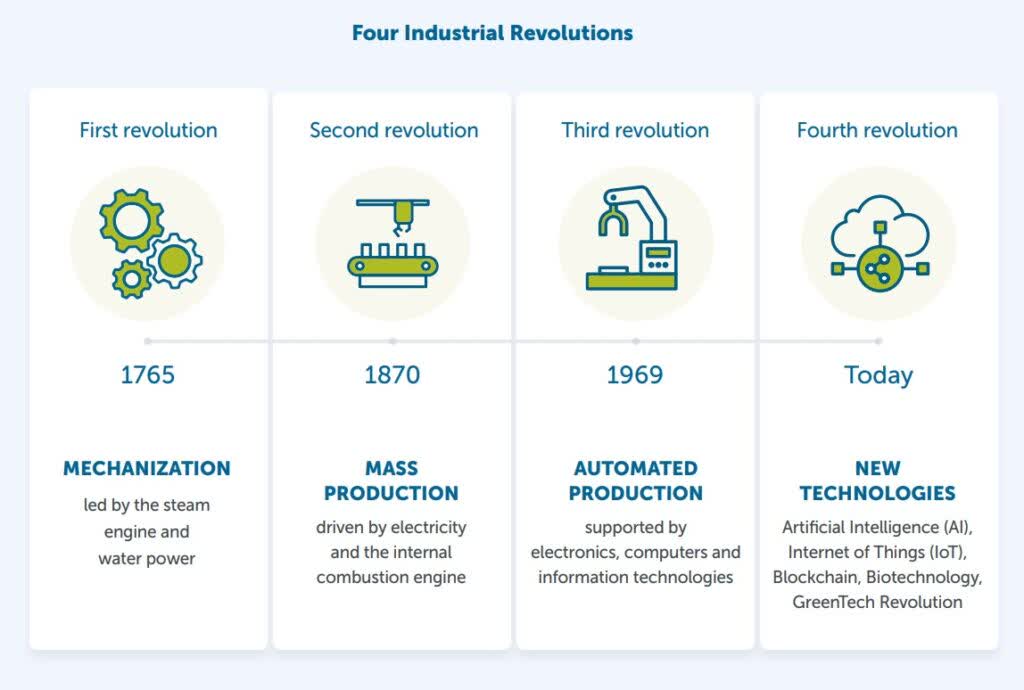

The Fourth Industrial Revolution: AI and Technology Redefining Growth

The Fourth Industrial Revolution, often seen noted as 4IR, is characterized by the fusion of digital, biological, and physical technologies, is accelerating economic transformation. Artificial intelligence (AI), robotics, and the Internet of Things (IOT) are driving productivity gains, but they also disrupt traditional industries and labor markets.

The Fourth Industrial Revolution is the convergence of digital, physical, and biological systems. These technological innovations are not only creating new industries but also redefining existing ones. The themes found within the 4IR will impact all of our other secular megatrends as we seek the development of solutions to problems and find opportunities to improve standard of living.

Productivity, Efficiency and New Business Models

AI, robotics, and IoT are driving productivity and operational efficiency across industries. Businesses are leveraging these technologies to reduce costs, improve production rates, and enhance product quality. The 4IR has also enabled entirely new business models, such as platform-based economies (think Airbnb and Uber) and the sharing economy, which have disrupted traditional sectors and created new markets.

Key Investment Themes in 4IR

- Artificial Intelligence and Automation: AI-driven automation is expected to contribute up to 14–15% to global GDP by 2030. AI is now used in everything from predictive analytics and supply chain management to healthcare diagnostics and autonomous vehicles (Morgan Stanley).

- Data as a Strategic Asset: The explosion of data-hundreds of billions of gigabytes generated daily-has made data analytics, cloud computing, and cybersecurity critical investment sectors.

- Smart Infrastructure and IoT: The proliferation of connected devices is transforming industries from manufacturing to healthcare, enabling predictive maintenance, remote monitoring, and smart city development.

- Digital Platforms and the Experience Economy: Companies that can create seamless, data-driven customer experiences are capturing outsized market share.

Labor Market Disruption and Creation

While automation and AI have displaced many traditional jobs, especially in manufacturing and routine white-collar tasks, they are also creating new roles that require advanced digital skills, technology development, and data analysis. The challenge-and opportunity-for investors is to identify companies and sectors that are not just surviving but thriving in this new labor landscape.

The Investor’s Perspective

- Diversification Across Tech Sectors: Investors should seek exposure to a range of technology-driven sectors, including AI, robotics, cloud infrastructure, and cybersecurity.

- Focus on Human Capital: Companies investing in workforce reskilling and digital literacy are better positioned for long-term success.

- Watch for Regulatory Shifts: As AI and data become more pervasive, ethical considerations and regulatory frameworks will play a growing role in determining winners and losers.

Aging Demographics: The Silver Economy’s Global Impact

Perhaps the most predictable-and investable-trend of the next several decades is the aging of the global population. By 2050, 16% of the world’s people will be over the age of 65, up from 9% in 2020. This “silver tsunami” is already reshaping labor markets, healthcare systems, and consumer preferences.

The Aging Population Boom

Every day, over 10,000 Americans turn 65, this will last until 2030. Similar trends are playing out across Europe and East Asia. This demographic shift is creating unprecedented demand for senior care, assisted living, healthcare services and various types of labor.

Senior Living and Healthcare Innovation

- Record-High Occupancy Rates: Senior living facilities are experiencing record-high occupancy, a trend expected to continue as the population ages.

- Shifting Consumer Preferences: Today’s seniors prefer smaller, boutique-style homes that emphasize personalized care and community, driving innovation in the sector.

- Healthcare Breakthroughs: Advances in biotechnology, genomics, and telemedicine are extending lifespans and improving quality of life.

Economic and Fiscal Implications

Aging populations mean a shrinking workforce and slower productivity growth, which can be a headwind for GDP expansion. At the same time, rising healthcare and pension costs are putting pressure on public finances. Investors should be mindful of these macroeconomic shifts when considering long-term allocations. Consider how we might use AI and automation to offset fewer workers in the future.

The Investor’s Perspective

- Healthcare and Senior Living: Investments in healthcare REITs, telehealth, biotechnology, and senior living facilities are poised for growth.

- Income-Producing Assets: As retirees seek stable income, dividend-paying equities, REITs and fixed-income assets become more attractive.

- Innovation in Care: Companies that can deliver cost-effective, high-quality care-especially those leveraging technology-will be at the forefront of the silver economy.

Climate Change: Green Investing and the Low-Carbon Transition

The urgency of addressing climate change has never been greater. The Intergovernmental Panel on Climate Change (IPCC) warns that global emissions must halve by 2030 to keep global warming below 1.5°C. Achieving this requires a fundamental shift in how we invest, making green investing more important than ever.

The Rise of Green Investing

Green investing refers to directing capital toward projects, companies, or financial products that promote environmental sustainability. This includes renewable energy, sustainable agriculture, electric mobility, and green infrastructure. Institutional divestment from fossil fuels has already kept over $40 trillion out of oil, gas, and coal companies, and individual investors are increasingly aligning their portfolios with climate goals. Indeed, investment in renewable energy now exceeds that in fossil fuels and the gap is growing.

Why Green Investing Matters

- Accelerating the Transition: Renewable energy, sustainable agriculture, and green infrastructure all require substantial funding to scale.

- Mitigating Risks: Climate change poses risks to traditional investments. Companies dependent on fossil fuels face regulatory, reputational, and operational challenges.

- Creating Impact: Every dollar invested in climate-positive initiatives helps reduce emissions, preserve biodiversity, and safeguard communities.

- Energy Security: Fossil fuels are finte resources that are getting more expensive to produce, energy security only can be maintained with renewable energy.

Trends in Green Investing for 2025

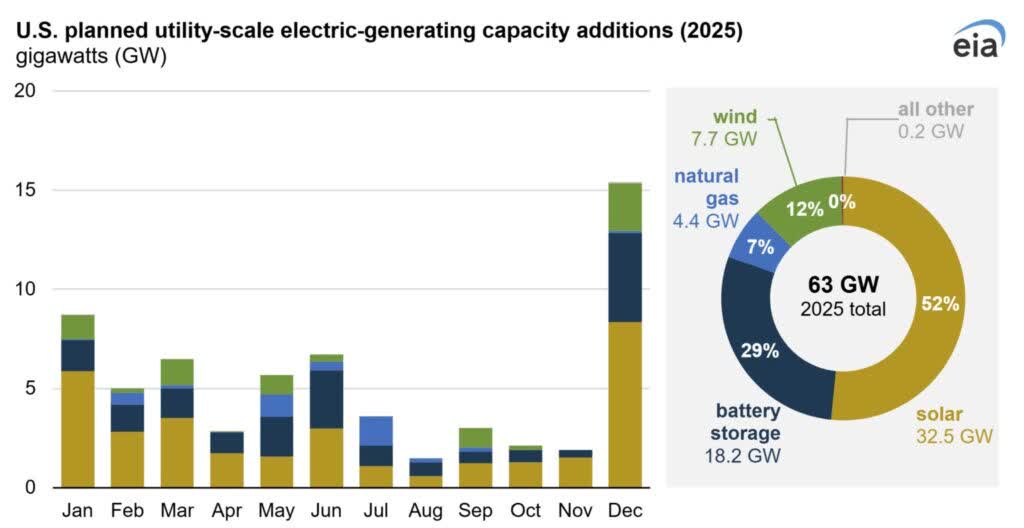

- Renewable Energy Expansion: Solar and wind capacity is projected to grow by 250% by 2030, fueled by falling costs and supportive policies.

- Energy Storage and Grid Modernization: Investment in grid-scale batteries and likely green hydrogen is critical to addressing the intermittency of renewables.

- Carbon Capture and Circular Economy: Technologies like direct air capture and sustainable materials are attracting significant investment.

- ESG Integration: Environmental, social, and governance (ESG) factors are now central to institutional investment decisions despite political fluctuations.

The Investor’s Perspective

- Diversify Across Green Sectors: Opportunities abound in renewables, energy storage, sustainable agriculture, and green infrastructure.

- Risk Management: Assess climate risk at the portfolio and asset level to ensure long-term resilience.

- Policy Awareness: Stay attuned to climate-related regulations and incentives, as these can rapidly alter the competitive landscape.

Multipolarity: The Rise of a Fragmented, Competitive World

The era of a single dominant global power is ending. By 2025, the international system will be a global multipolar one, with the rise of China, India, and other emerging powers (Global Trends 2025 Report, DNI). This shift is fragmenting supply chains, trade networks, and investment flows.

The Rewiring of Global Commerce

For decades, integrated global markets created wealth and buoyed economies. But rising geopolitical tensions, supply chain vulnerabilities, and economic dependencies are shifting priorities. Policymakers are focusing on national and economic security via less open trade and more local control over supply chains.

Ultimately, I expect things to work out well, but the ride there is certain to be bumpy and frightening sometimes. As investors, I would remind you of grandpa’s advice to “follow the money” to know how things work and will work out.

Key Features of the Multipolar World

- Regionalization and Friend-Shoring: Companies are moving production closer to home or to allied countries to reduce risk, this is largely possible by 4IR, not necessarily a political motivation.

- Critical Mineral Security: Nations are racing to secure supplies of lithium, cobalt, and rare earths for clean energy and technology.

- Emerging Market Growth: Asia-Pacific, Africa, and Latin America are gaining economic influence, while traditional Western alliances are weakening.

- Urbanization: By 2050, nearly 70% of the global population will live in cities, driving demand for smart infrastructure and resilient supply chains (Investment Banking Council).

The Investor’s Perspective

- Geographic Diversification: Exposure across regions helps mitigate country-specific risks and capture growth in emerging markets.

- Resilient Supply Chains: Sectors benefiting from supply chain reconfiguration and regionalization may outperform.

- Safe Havens and Volatility Hedges: In times of geopolitical stress, allocations to assets perceived as safe havens-such as gold, commodities, or defensive equities-can provide stability.

Synthesis: Building a Future-Ready Portfolio

The interplay of these four trends creates a new investment paradigm. Investors must think thematically, globally, and with a long-term perspective. These strategic priorities for investors will be keys.

- Diversification Across Megatrends: Balance exposure to high-growth technology with defensive healthcare and climate assets.

- Active Risk Management: Monitor regulatory shifts in AI, carbon pricing, trade policy, and supply chain security.

- Long-Term Horizon: Focus on structural shifts and avoid being swayed by short-term volatility.

- Adaptability: Be ready to adjust allocations as new technologies, policies, and geopolitical realities emerge.

Thriving in an Era of Transition

The Fourth Industrial Revolution, aging demographics, climate change, and multipolarity are not isolated trends – they are deeply interconnected forces shaping the investment landscape for decades to come. Each trend carries its own risks and opportunities, demanding an approach that is diversified, adaptable, and resilient.

Clients and readers will often hear me talk about how uncomfortable transitions are. People prefer stability, but instability is inherent to change.

Markets will continue to be emotional, which means price swings that are not necessarily reflective of the fundamentals, to both the upside and downside. We must be emotionally balanced in order to take advantage of both buy low and sell high opportunities.

A poker saying is “embrace the variance.” It means, understand that even when you make the right bet, sometimes you don’t win the hand because the simply don’t run out your way. It happens. With investing, I would amend that saying to “embrace the volatility.” Keep making good decisions and over time, things will work out excellently, even if not perfectly.

Investors who understand these trends, anticipate their impacts, and position your portfolios accordingly will be best placed to thrive in this era of transformation. The future will reward you for blending insight, agility, and patience in the face of historic change.

Kirk Spano

Founder | Head of Investment Research and Analysis