Summary

Stagflation, a combination of low economic growth and high inflation, is a concern for the US economy.

The Federal Reserve is facing a conundrum as it tries to maintain a soft economic landing while reducing inflation.

Factors contributing to inflation include the economic impact of the pandemic, OPEC’s manipulation of oil supplies, and a housing shortage.

Justin Sullivan

An old “new word” has entered the economic and market narratives in recent weeks: Stagflation. It’s an old word because the United States suffered from two bouts of “stagflation” from the middle 1970s to early 1980s. It’s a new word because there’s a new generation of market participants.

Stagflation is an economic cycle when economic growth is low (the “stag”) and inflation (the “flation”) are high. Low growth in past bouts also included high unemployment. A key factor in those stagflations was OPEC’s manipulation of oil supplies.

I have written about the possibility of stagflation twice here on Seeking Alpha:

Today, I will cover the conundrum the Federal Reserve faces as it tries to maintain the soft economic landing while continuing to drive down inflation.

Blame Inflation On The Fed

I am a big South Park fan and always thought the “blame Canada” storyline was a great piece for pointing out how we often blame the wrong reason for a perceived problem.

Today, there’s a narrative shared by traders and politicos alike that the Federal Reserve is “to blame” for the inflation we have seen the past few years. That narrative is mostly wrong, in my opinion.

Once again, I remind you that we saw a once in a century pandemic that shut down the economy. Closed the economy cold. An economic heart attack followed by a coma. Here it is in chart format from a Macro Hive article two years ago.

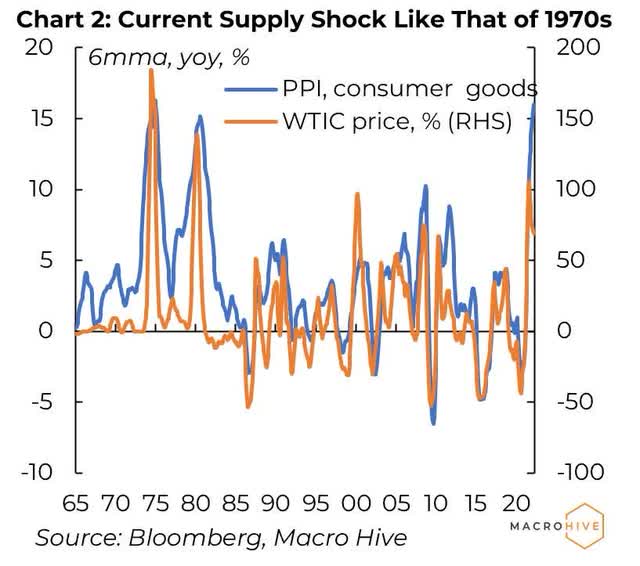

Supply Shocks (Bloomberg, Macro Hive)

As you can see, the supply shocks suffered from COVID were as great as those during the oil shocks of the 1970s.

So, while many people brush aside the economic impact of COVID for ideological, political or personal financial reasons, that does not make their analysis right, even though they have the right to that rationalisation.

The economic reality of COVID, at the time, was that massive bailouts were indeed necessary and that erring on the side of “too much” and not “too little” was the correct approach. The alternative was to risk a potential depression.

The bailouts were not just from the Federal Reserve, though. The federal government in 2020 under President Trump and in 2021-2022 under President Biden poured money into the economy, first to save it and then help it recover.

I believe the federal government’s spending via President Trump’s initial bailout, followed by President Biden’s American Rescue Plan, the Infrastructure Investment and Jobs Act, the Inflation Reduction Act and bipartisan CHIPS and Science Act, are core reasons for the highly employed and rising wages soft landing that we are experiencing now.

The byproduct is a cyclical, aka transitory, bout of inflation that will be forgotten in a few years when we start to talk about deflation again in the face of Baby Boomer mass retirement.

OPEC+ Energy Manipulation

One of the key components of inflation has always been energy. We can see that going back a century in the data. It was most acutely felt during the 1970s and early 1980s stagflationary periods.

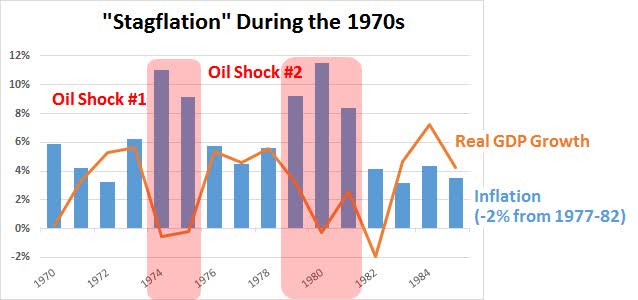

1970s Stagflation (Mother Jones)

The 1970s and this decade have a very key component in common. OPEC is manipulating the oil supply in order to drive prices higher.

Saudi Arabia in particular is leading the charge to keep oil prices over $80 per barrel. They have both financial and political reasons for doing so. Financially, they need oil above $80 to have a balanced budget.

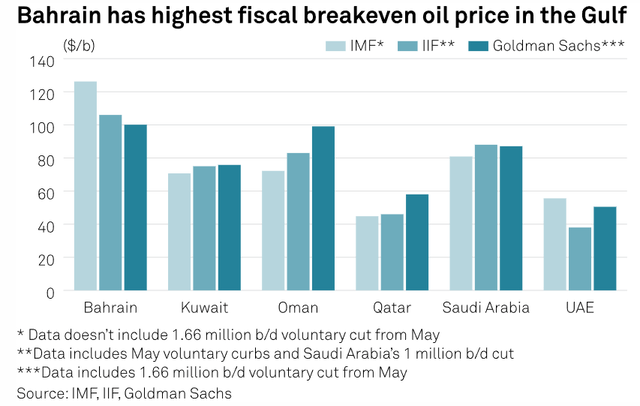

OPEC Breakevens (IMF, IIF, Goldman Sachs, SP Global)

Political motivations are intangible, inherently fluid and cloaked in riddles wrapped in mysteries inside of enigmas (credit Churchill). What we do know is that there’s little love lost between President Biden and Prince Mohammed bin Salman Al Saud. It’s more than a little plausible that the latter is keeping oil prices higher to hurt the former.

And this is why manipulating supply drives price.

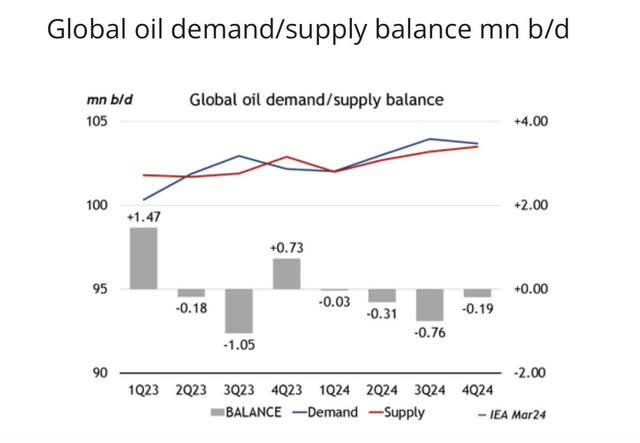

Oil Demand/Supply (IEA)

As we know from Econ 101, price is made at the margins. With oil supply and demand being tight, even small decreases in oil supply can drive price higher.

I cited OPEC+ in the section title. The + is Russia in the acronym. I do not want to spend much time on their actions, we know what they are. Not only have they cut back on supplies as well, but they have disrupted the international energy system with their invasion of Ukraine.

Housing Shortage Impact On Inflation

The United States has had a housing shortage since shortly after the Financial Crisis and Great Recession. It’s not a problem easily or quickly solved.

Housing is suffering from higher interest rates thwarting new construction at both the personal and institutional levels.

At the personal level, it’s very difficult for most Americans to finance a new home purchase or construction with rates so high, on top of home and building prices being historically high.

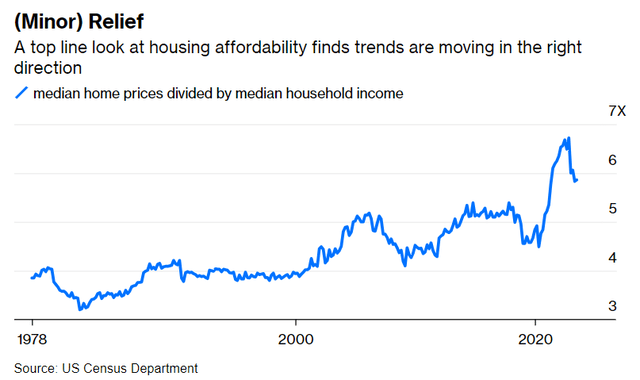

Housing Affordability (U.S. Census, Bloomberg)

That’s an important chart as it shows the Fed’s problem. Housing costs make up more than 40% of the Consumer Price Index.

How do you bring down relative housing prices without causing a recession? Higher rates and QT have helped. Incomes rising lately have also helped.

Clearly though, there’s more to do, and it might not be the answers people think, as I’ll discuss below.

At the development level for multifamily housing, I speak with readers regularly about the issues my side hustles in private equity real estate development has seen the past 18 months or so.

With rates at current levels, it’s difficult to get equity investors with Internal Rates of Return hovering near 12%. Let me explain.

While a 12% IRR was normal for a very long time, investors have gotten spoiled by low interest rates and have become accustomed to 15% IRRs. That has put multifamily housing projects on hold around the country.

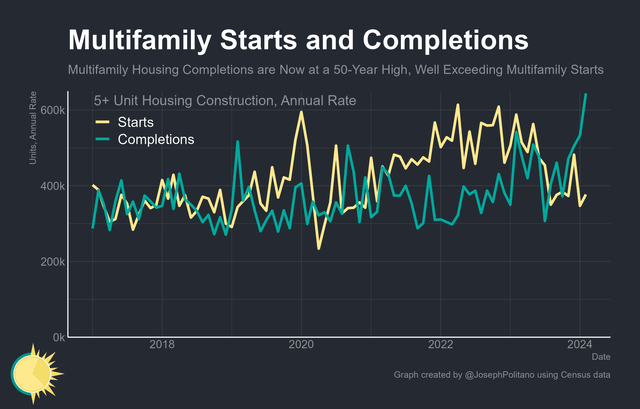

Multifamily Starts & Completions (Apricitas Economics)

Note that starts have fallen dramatically the past year. If that lasts, we have a bigger housing problem a year or two out after the recent completions are filled.

I know of multiple projects in the $20-50 million range that can’t be done right now without a lot more dilutive equity investment or higher interest rate debt. It’s a tough market right now, especially with banks dealing with an inverted yield curve.

Inflation Is Falling

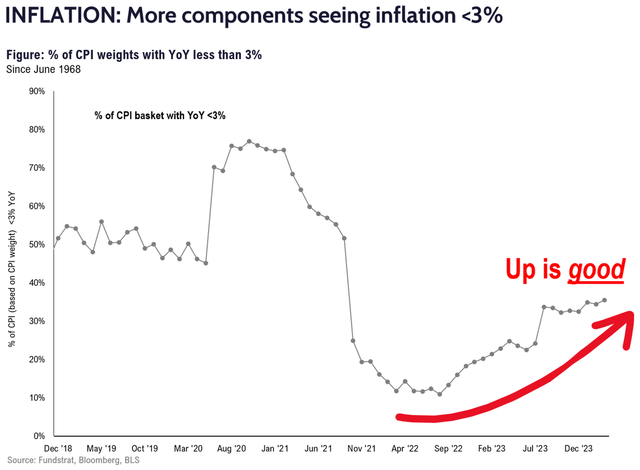

Despite the narratives claiming we’re in a long-term inflationary period, the data really does not support that idea. Here’s a chart from Tom Lee at Fundstrat:

Falling Inflation By Component (Fundstrat, Bloomberg, BLS)

What that’s showing is that fewer and fewer components of inflation are showing inflation above 3%. In fact, inflation by component is almost inline with pre-COVID again. As noted above, energy and housing remain higher.

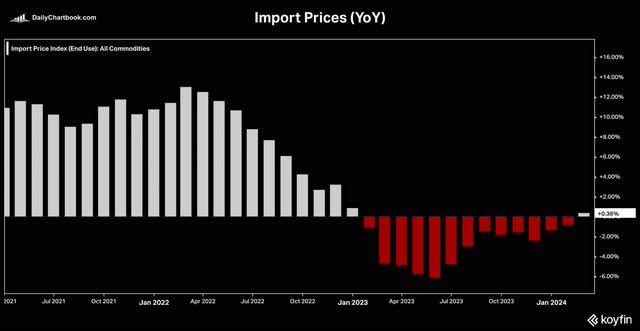

We can also see that prices have fallen for imported goods since the Fed tightening cycle.

Import Prices (Koyfin)

That’s largely to do with the stronger dollar, which has happened because of higher interest rates and quantitative tightening.

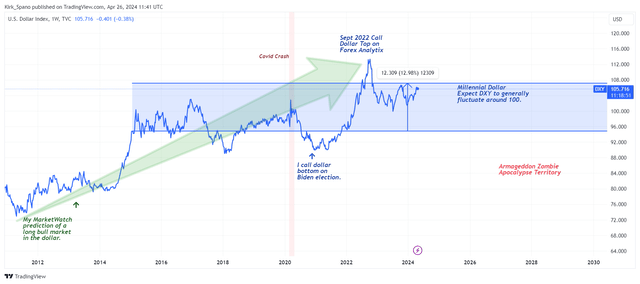

Dollar Bull Market (Kirk Spano)

I foreshadowed the current situation early last year with a piece titled It’s Not Interest Rates, It’s The QT.

Armchair economists will point to rising wages as inflationary. I suppose a bit, but, let me ask you, do you want falling wages? With inflation ticking in at 2.8% last week, I think it’s reasonable to think that suppressing wages within a recession is not the best solution.

The Economy Is Starting To Cool

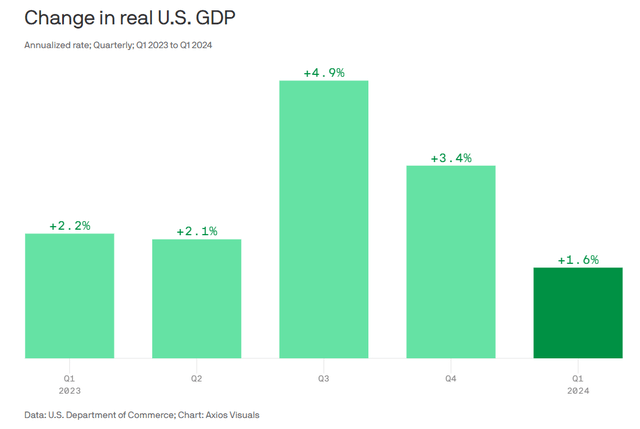

Unfortunately, we just saw that Q1 Real GDP was only 1.6%. That is lower than we would like to see. And it’s potentially a harbinger of potentially weaker future readings.

Real GDP (BEA, Axios)

Of course, if inflation falls, then real GDP can improve without nominal growth. It also means that if nominal growth increases, but inflation remains the same, then real GDP rises.

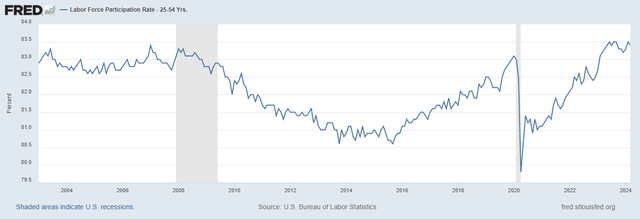

This is important in the context of remaining at full employment, which has been the number one signal of recessions historically. Right now, unemployment is only 3.8%, which implies full employment. A look at the Labor Participation Rate for 25-54 year-olds shows that we’re back to norms post Dot.com crash recession.

Labor Participation Rate (FRED)

In my opinion, this is the most important set of relationships in the economy, far exceeding a point of extra inflation. We need labor participation to remain closer to the middle than lower 80% area and for unemployment to stay under 5%.

If we see inflation stay high and nominal growth slow, then real GDP slows, which has always led to layoffs. In that scenario, stagflation takes hold.

The Fed Must Find Balance

We are at a delicate spot economically. There are external forces impacting the economy that are out of our control right now (and I didn’t even discuss China). Internally, we continue to play politics with the Federal budget, taxes and the regulatory system.

That leaves the Federal Reserve to try to play Superman. It’s not really fair, but it is what it is. To my way of thinking, and remember, I was skeptical of Jerome Powell when President Trump appointed him, he has done a pretty good job.

That said, he could make a huge mistake here by focusing too much on inflation and worrying about what a bunch of narrative spinners think and say.

If Powell does not start to wind down QT soon, he runs the risk of causing a liquidity spiral down the drain. It’s actually a very serious issue that’s overlooked, and I will expand upon in coming weeks.

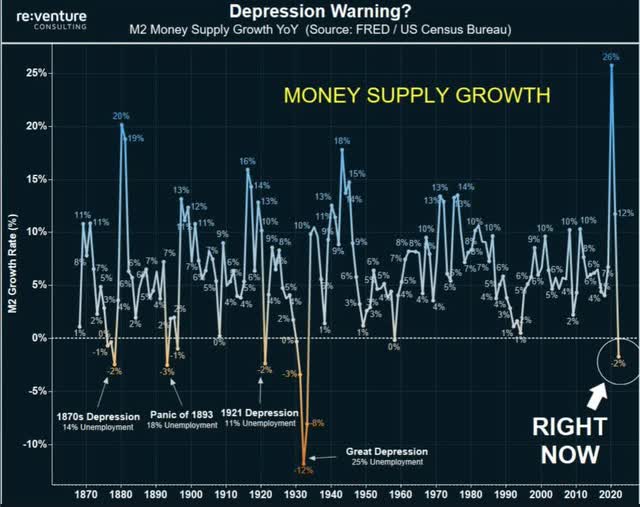

Here’s something to think about. Money supply is plunging.

M2 Plunge (Venture Consulting)

That only shows rate of change, and we have to consider that’s off a very high base from all the liquidity injections from 2020 to 2022. That said, plunges in money supply have had bad consequences in the past.

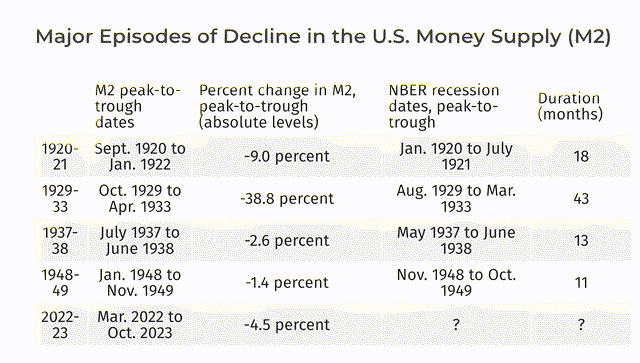

Money Supply Collapse Results (Wolf Street)

I do not believe that the Federal Reserve is going to make a mistake here and let liquidity plunge. I talked about how the tightening cycle was just the Fed reloading its bazooka for the next time it needed to loosen. I believe that. But mistakes get made, and we will have to pay attention.

Author

Kirk Spano

CEO/CIO — Fundamental Trends

Kirk is an Accredited Investment Advisor and founder of Fundamental Trends and Bluemound Asset Management LLC. Kirk has been highly successful in helping DIY investors make sense of the investment world, and profit in stocks, ETFs and crypto.