Summary

Market action is incoherent, suggesting a need for a bigger breather.

Sell in May and go away may play out this year, with a tough May for stocks expected.

Fed Chairman Powell’s actions next week may lead to a correction of 5-10% on the S&P 500 index.

You’ll want to deploy cash on any significant correction in my opinion.

Adam Gault/OJO Images via Getty Images

I haven’t written a quick thoughts in a while, but thought it made sense today. The action in the markets is just so incoherent right now it seems like a bigger breather is in order than what we just had.

From a seasonal standpoint, there as precedent for a small rally after option expiration and the final big retirement plan contributions until year-end. That happened on Monday and Tuesday.

On Tuesday, technicals started to breakdown again as many stocks turned over during the day. Futures around midnight in Milwaukee are pointed decidedly down after Meta (META) caused frowny faces.

“Sell In May And Go Away?”

Sell in May and go away is an old Wall Street saying. It plays into seasonality themes. It hasn’t played out so well since the Financial Crisis, but there is statistical validity.

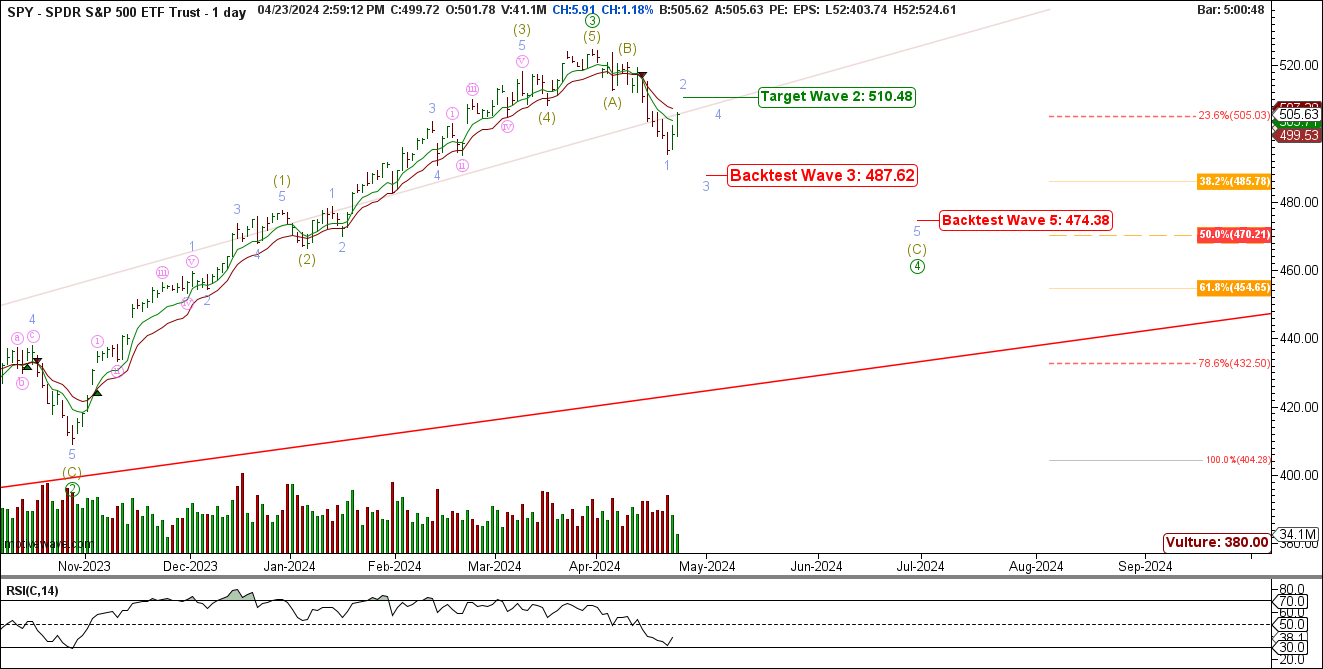

I think with Fed Chairman Powell very likely on a “mean setting” next week, we should expect a tough May for stocks. If I am right and we see some correction, I’d think in the 5-10% range on the S&P 500 index (SPY) (VOO), that would equate to bigger corrections across a lot of stocks that are smaller than a mega caps.

Here’s what Shooter sees.

SPY to $470s (Shooter)

If you didn’t raise cash yet, you can do some quick trimming of large caps. There is not much point to trimming anything else as almost everything else is beat up or about fairly valued right now.

Let your covered calls sit out there as they will in most cases expire in May, which is where most are likely written to.

Come Back Quick If You Go

We’ll want to be buyers of several S&P 500 stocks, as well as, some that fall in sympathy – in particular, REITs because they will benefit from lower rates sometime this year. If you haven’t already gotten to the leading edge of your SMID allocation, you’ll want to do that too.

Monthly inflows to markets generally happen the last couple days of the month into the second week of the new month (retirement plans and institutions cause this). That means we will see some inflows again going into the June Fed meeting.

I still think the Fed lowers in June. Maybe it’s July. We’ll see. But, to loosen up housing, take pressure off banks and help the U.S. Treasury now that we are out of tax receipt season, June makes sense to me.

Maybe they do explain it as a potential one off rate decrease versus the start of a new loosening cycle. Again, we’ll see. What they say they are going to do and what they get around to doing are likely different. Remember, the Fed is managing expectations as much as anything.

Sometimes the Fed wants us to think one way, but then they do the opposite to get a particular reaction. Doing a cut and describing it as potentially a one-off would loosen possibly without causing markets to get nausingately speculative again up top. I doubt it, but the Fed might give it a try.

The reality in my opinion is that half of people are not going to stop indexing until they see smaller capitalization stocks lead for over a year. When the masses finally buy small caps that will give us about a year to collect our gains and sell to the last folks in the door. My guess, late 2025 or early 2026 is when we see the bigger bad thing I worry about. The Big Boom!

Author

Kirk Spano

CEO/CIO — Fundamental Trends

Kirk is an Accredited Investment Advisor and founder of Fundamental Trends and Bluemound Asset Management LLC. Kirk has been highly successful in helping DIY investors make sense of the investment world, and profit in stocks, ETFs and crypto.