Summary

- Inflation theory is not solely based on money supply, but also on the velocity of money and supply and demand imbalances.

- Recent excess monetary and fiscal stimulus post-Covid raises questions about the impact on inflation and potential economic consequences.

- Falling inflation and flattening employment will lead to rate cuts this quarter.

- Select SMID caps, REITs, emerging markets and Bitcoin are where expanding breadth will lead prices higher.

The big news for Q3 2024 will be that the Federal Reserve finally cuts interest rates after a year of anticipation. The question is whether that will scare the markets or drive stock prices higher? The short answer is we will see a continued rally after the election in stocks, real estate and Bitcoin. But, only one will avoid the next bit collapse.

Some things to think through as we decide whether to get more invested.

Inflation Is Not Always 100% Monetary

If the Federal Reserve does indeed cut interest rates, the breathy “Inflationistas” will chant even louder. But, will they be right as recent memory suggests, or will they be wrong like the past 4 decades?

The dogmatic believers in Friedman’s and Schwartz’s idea that “inflation is always and everywhere a monetary phenomenon…” might have a point. But, the quantity theory of money seems to only partially explain inflation.

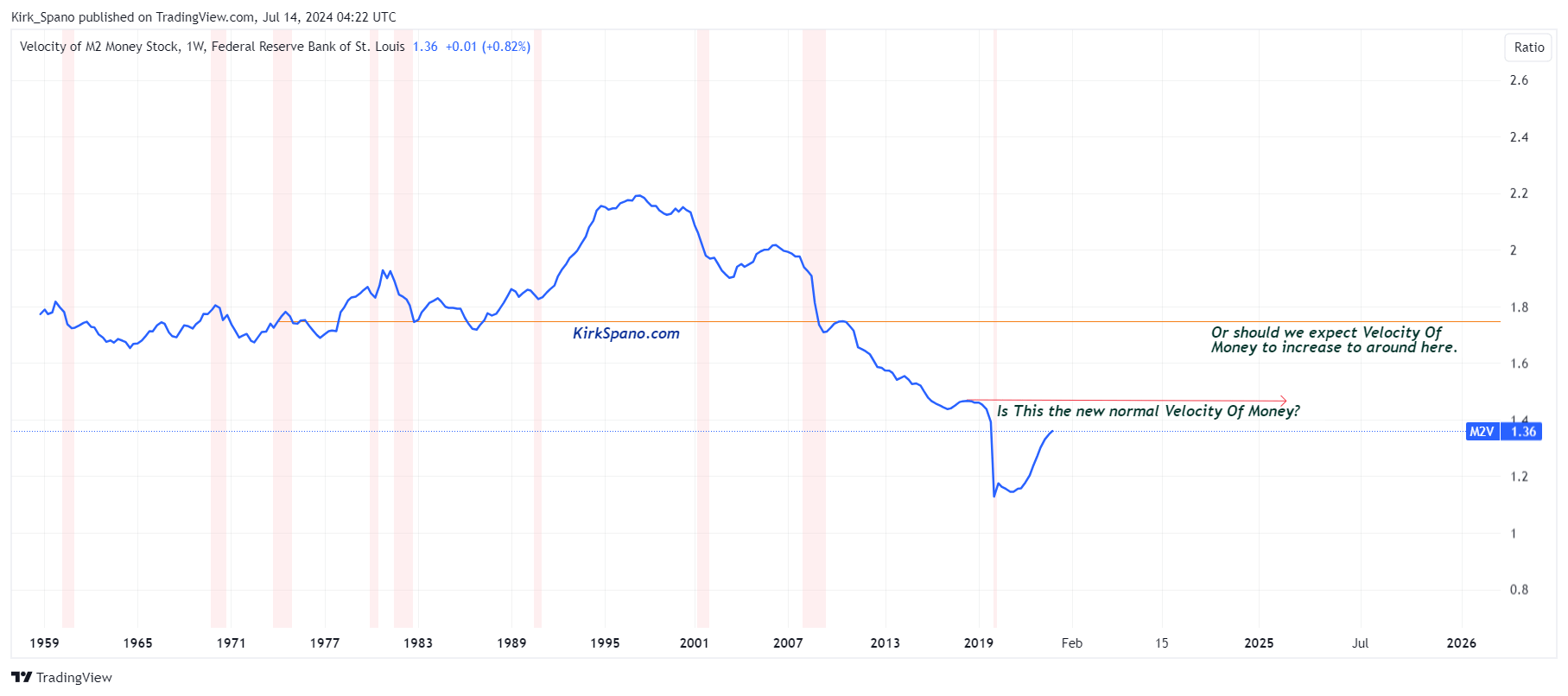

Economists have found that the “velocity of money,” as well as, supply and demand imbalances have dramatic impacts on inflation.

The sudden jump in velocity of money from non-existent during the shutdowns, could reasonably be explained to added to inflation. A good question to ask now might be, “what if velocity of money continues to rise?” Another might be “what if current velocity is the new normal?”

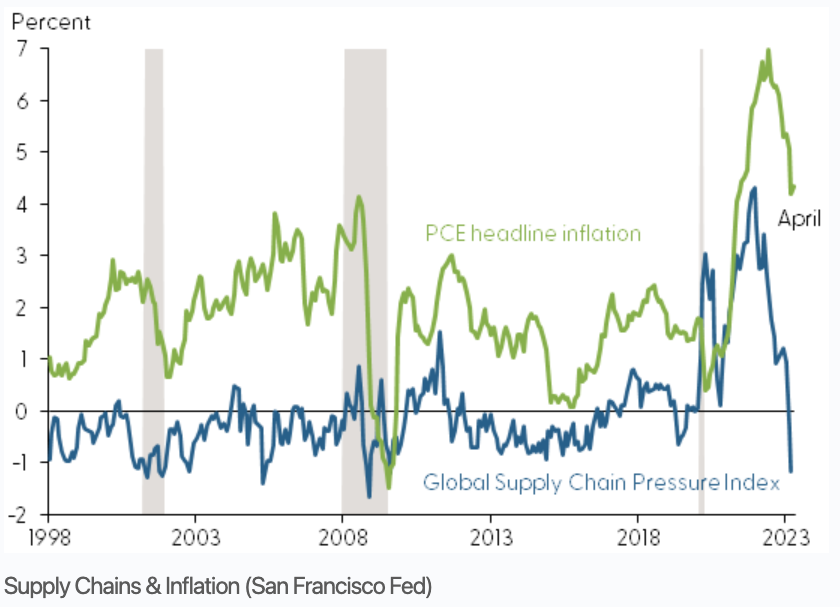

The correlation between supply chain pressures and inflation is fairly easy to see in the chart below.

The San Francisco Federal Reserve branch studied the matter rather in depth.

Global Supply Chain Pressures and U.S. Inflation – San Francisco Fed

The bottom line is that the full accounting of inflation is not a simple equation where one can simply say that “more money supply equals more inflation.” What we definitely can say is that inflation is more complex and more difficult to explain that we want it to be.

Covid Still Matters

After Covid, we saw massive monetary and fiscal stimulus. Emphasis on “and fiscal.” I have noted dozens of times that the combined monetary and fiscal Covid responses we saw during the Trump and Biden administrations were far more than the hole that was ultimately blown in the economy.

The excess stimulus could be attributed to a number of things. There was legitimate fear of the economic damage that Covid might do. Afterall, despite the rhetoric, nobody really knew how serious Covid would be. Indeed, there were at least 7 million global deaths from Covid.

A spike in global infections driving some herd immunity and then vaccines coming at “warp speed” ultimately short circuited Covid by late 2022. That begs the question, was there also a “never let a good crisis go to waste” mentality at play for fiscal programs?

Over the past two years, fiscal stimulus meant to “build back better” has been filtering into the economy and will continue to do so through at least 2032 based on the bills written into law. Programs to build semiconductor plants, solar and battery supply chains, EVs, a smart grid, infrastructure and more will continue.

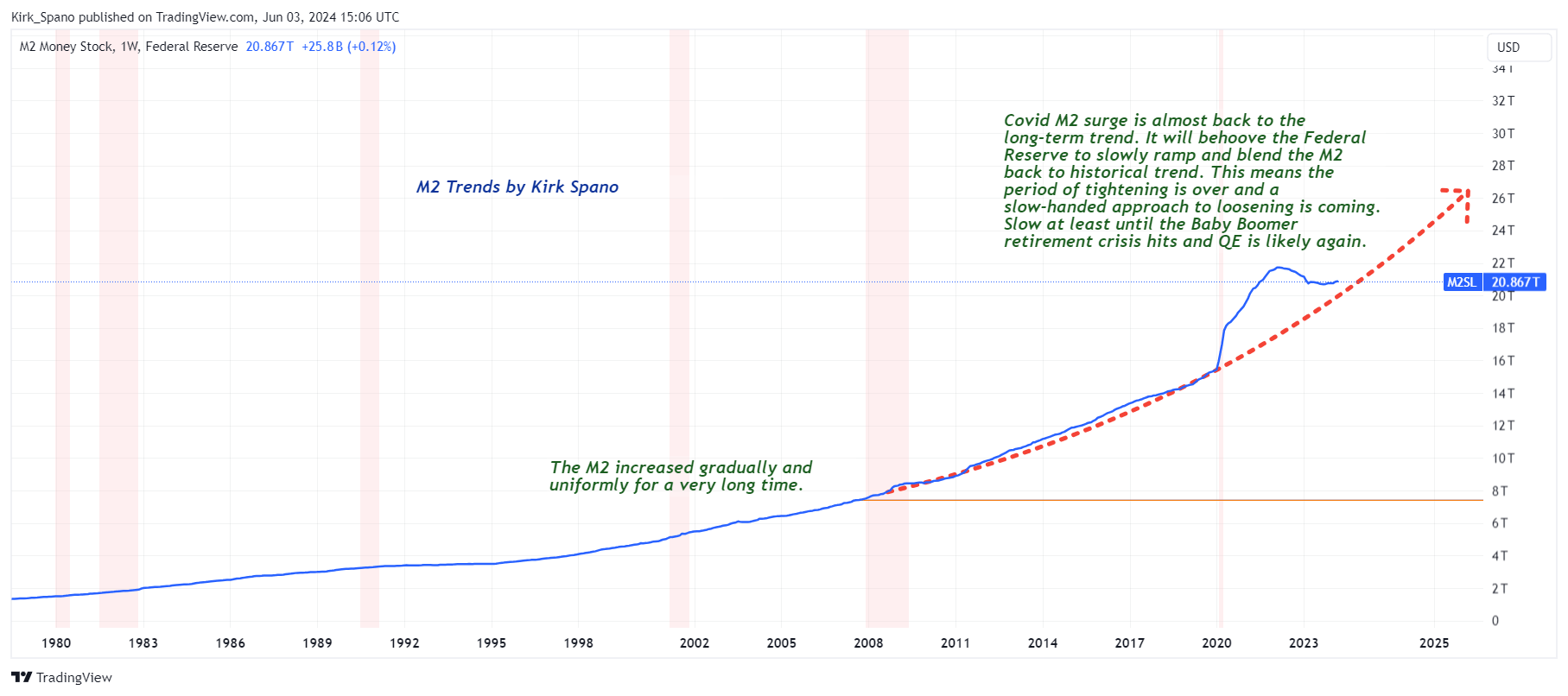

That expansionary fiscal policy is in the face of QT – quantitative tightening meant to reign in the money supply (if QE is money printing, then QT is money retiring).

The fact is that inflation has been slow to fall, despite M2 money supply coming down. This is unusual and points to a simple reality: there was a burst in stimulus that had to be worked through. It’s nothing heinous if you consider the situation of uncertainty that Covid presented.

Historically, a drop in money supply similar to what we have seen the past two years has always resulted in a recession or depression. Stop.

The difference this time was the massive preceding stimulus that created a historic monetary and fiscal stimulus overhang. Jeffrey Gundlach echoed this idea in recent interviews with Doubleline and Bloomberg.

We are at the point now that if M2 falls any lower, it will fall below the historical trendline. That would be deflationary and a recession becomes much more likely. We need to see money supply start to grow again soon.

Inflation Is Almost Gone

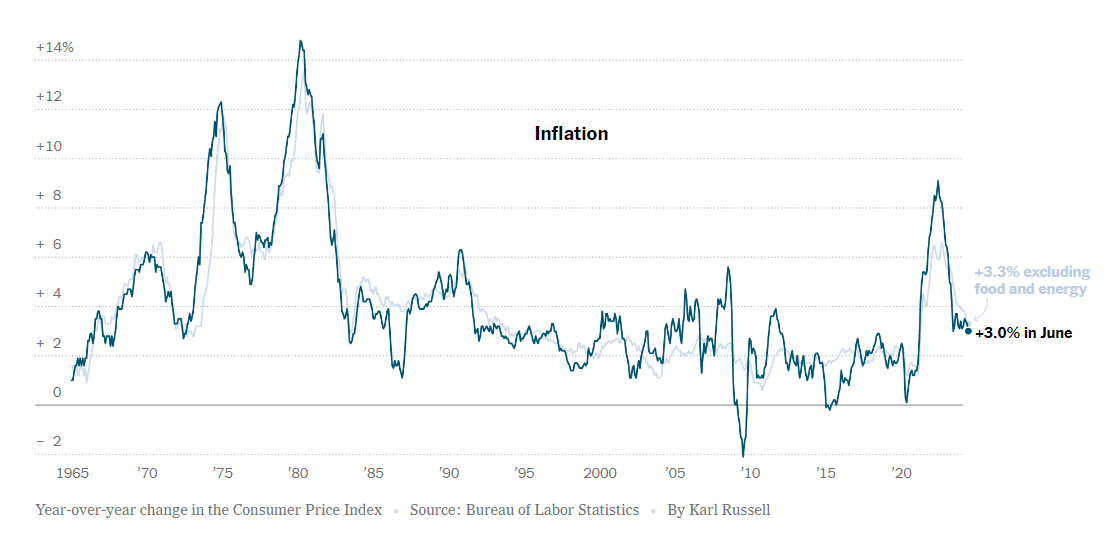

Inflation spiked following the reopening from Covid and resultant revenge spending (pent up demand) that continued into slow to slow stimulus.

Inflation has clearly peaked and come down dramatically to within 1% of the target rate of 2% set by the Fed. But, as I said back in late 2021, Inflation Is Transitory, Most Prices Are Permanent.

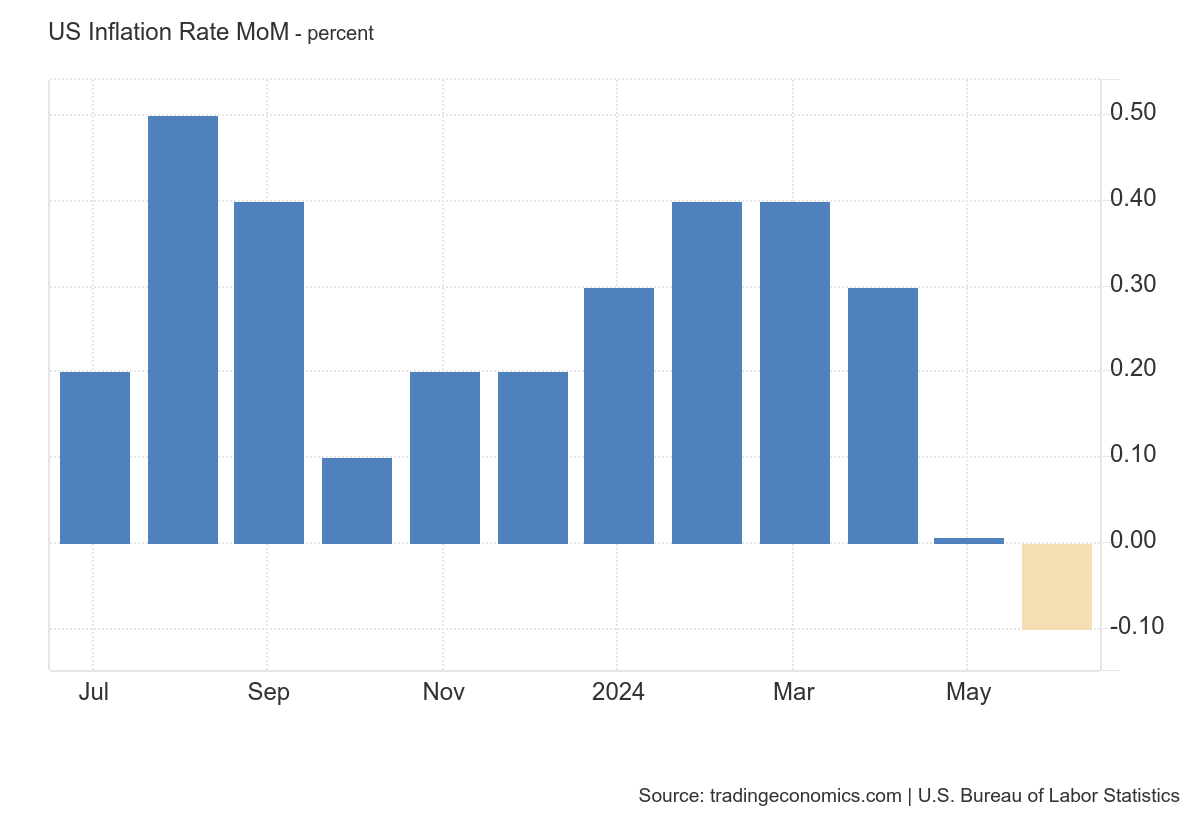

In fact, inflation has slowed dramatically into summer, which was not entirely intuitive. The month over month inflation rate is essentially zero.

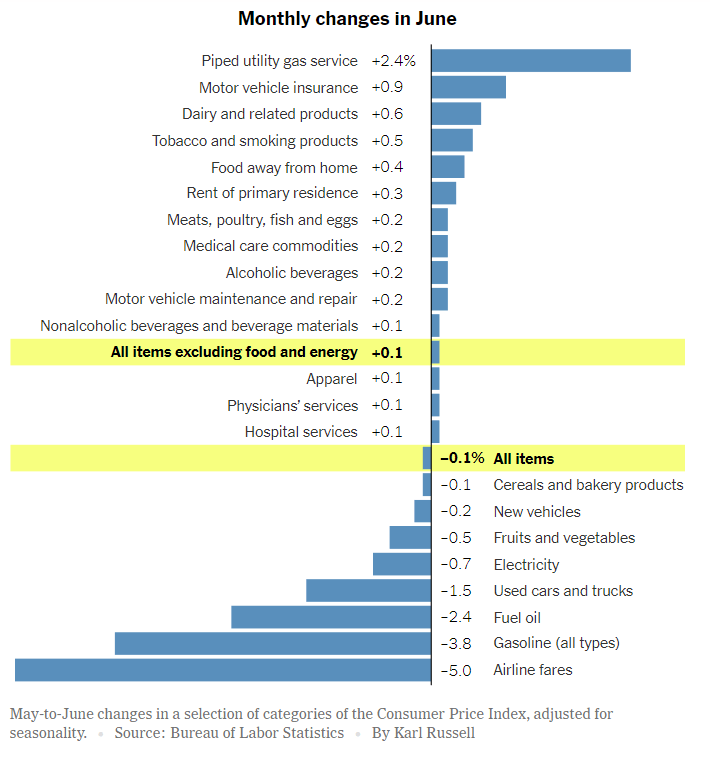

Inflation is clogged into a few segments. Natural gas bottomed recently and is rising. We have talked about the investment opportunities there.

Vehicle insurance is still unusually high, but is lower than recent readings, so is falling. Housing costs are still higher than the official target, but more about that below.

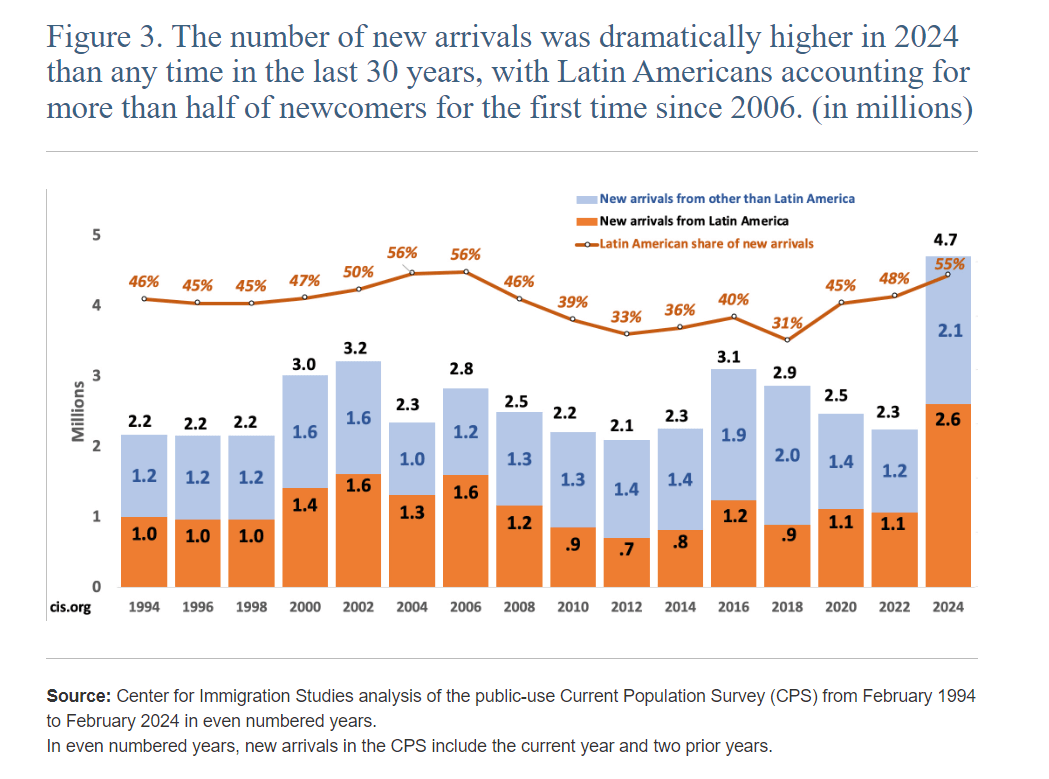

Food and some staples are still still stubbornly high, but immigration likely had some impact on reducing fruit and vegetable costs due to an increase in agricultural workers. According to BLS, there are about 800,000 agricultural workers, but we have been over 100,000 short most years.

While there are negatives to how we do immigration, it has become abundantly clear that we need it to offset retiring Boomers.

With about 3.5 million Baby Boomers retiring each year for through decade end and quite a few the following years, offsetting a shrinking labor force becomes very important. A shrinking labor force could be very inflationary if we do not have enough people to do the jobs required to support a very large retired population.

Without enough immigration to both supply labor and offset different spending patterns of an aging population (more healthcare, less everything else), we could face a stagflationary situation in the 2030s. The recent surge seems to have bent the curve to where we need it if we maintain immigration around 3 million people per year going forward.

Employment Is Softening

Employment numbers have returned to target, but the trend is a bit threatening. Jerome Powell talked about this in his recent testimony to Congress.

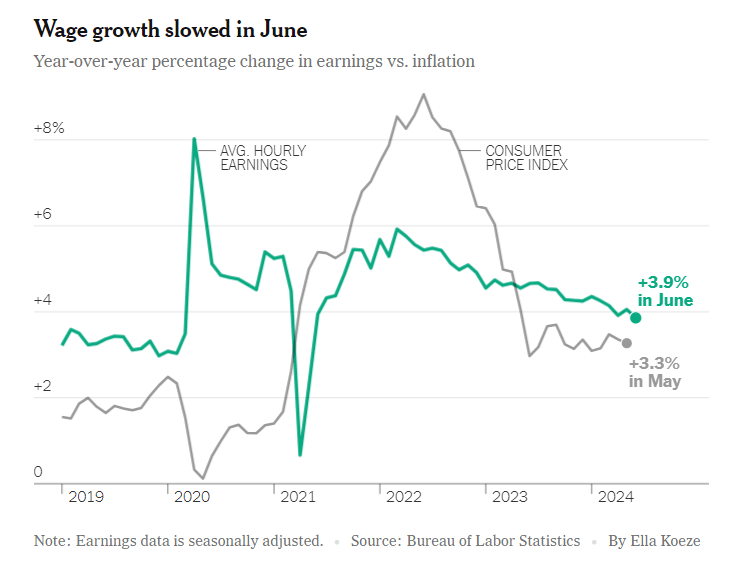

Positively, wages are exceeding inflation for the past year and if we can prevent a recession, the trend should persist.

Negative Surprises Are Piling Up

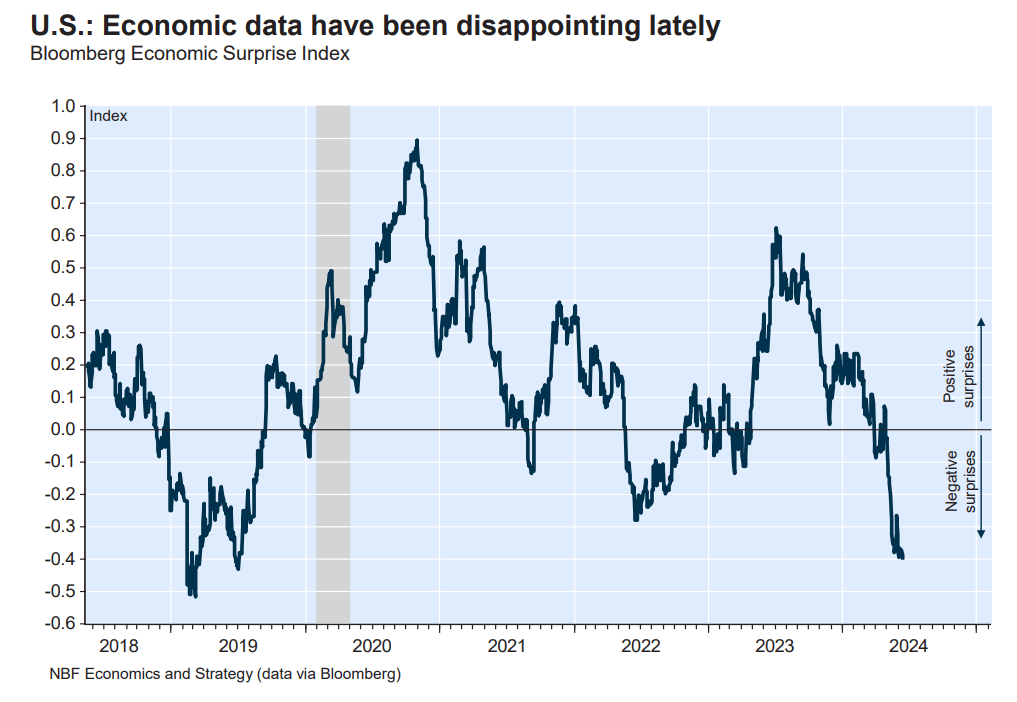

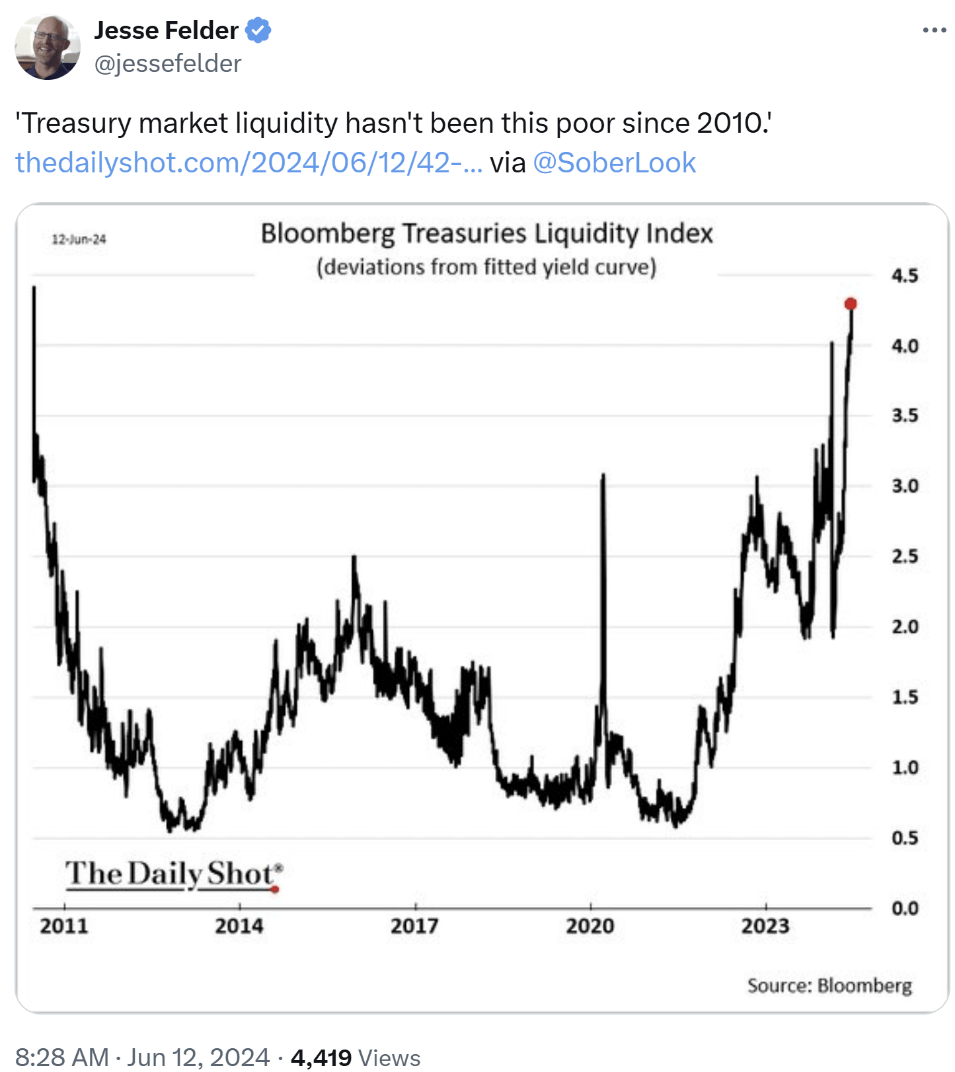

The Bloomberg Economic Surprises Index has fallen to its lowest level since July 2019. Remember that by September of 2019 the Federal Reserve was bailing out the Repo market with QE that wasn’t called QE.

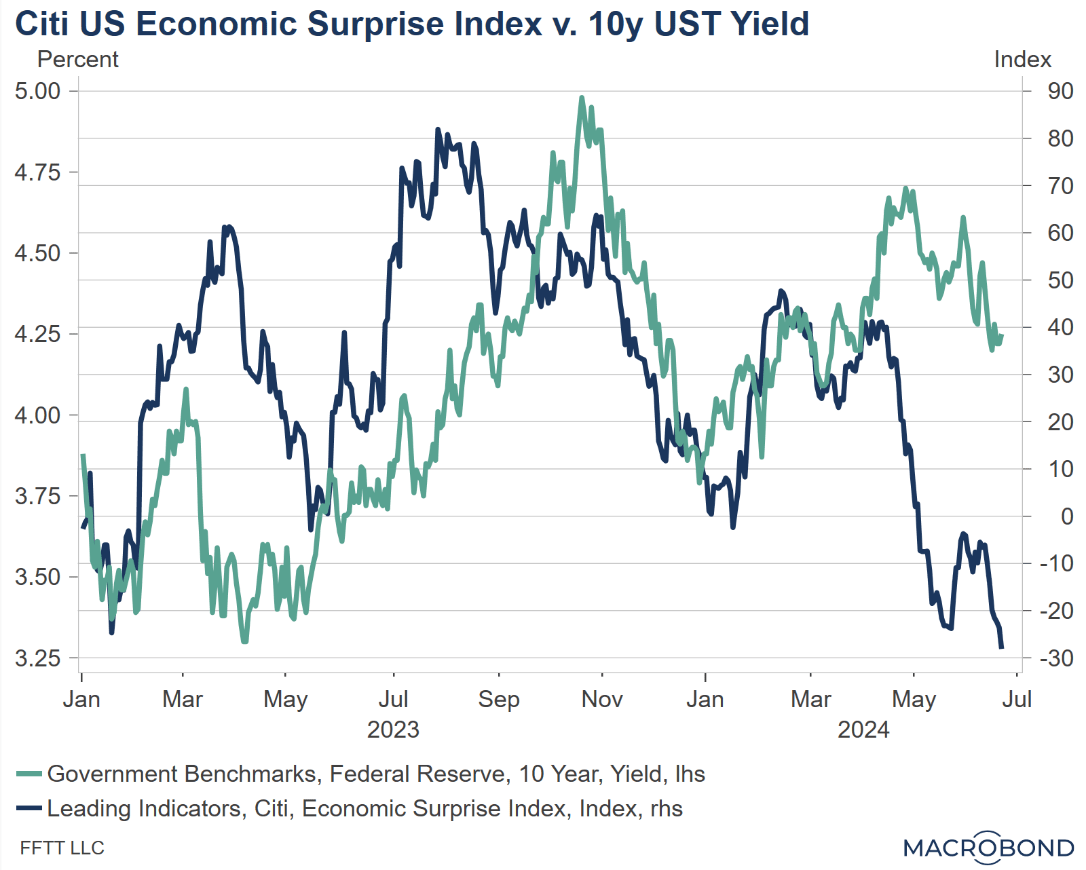

Citi draws the correlation between 10-year UST yields and economic surprises. We see alligator jaws and what do we know about alligator jaws? They always close.

Back in late 2019 I warned about an impending recession potentially with stagflation. Covid hit, so, we did not see if that played out.

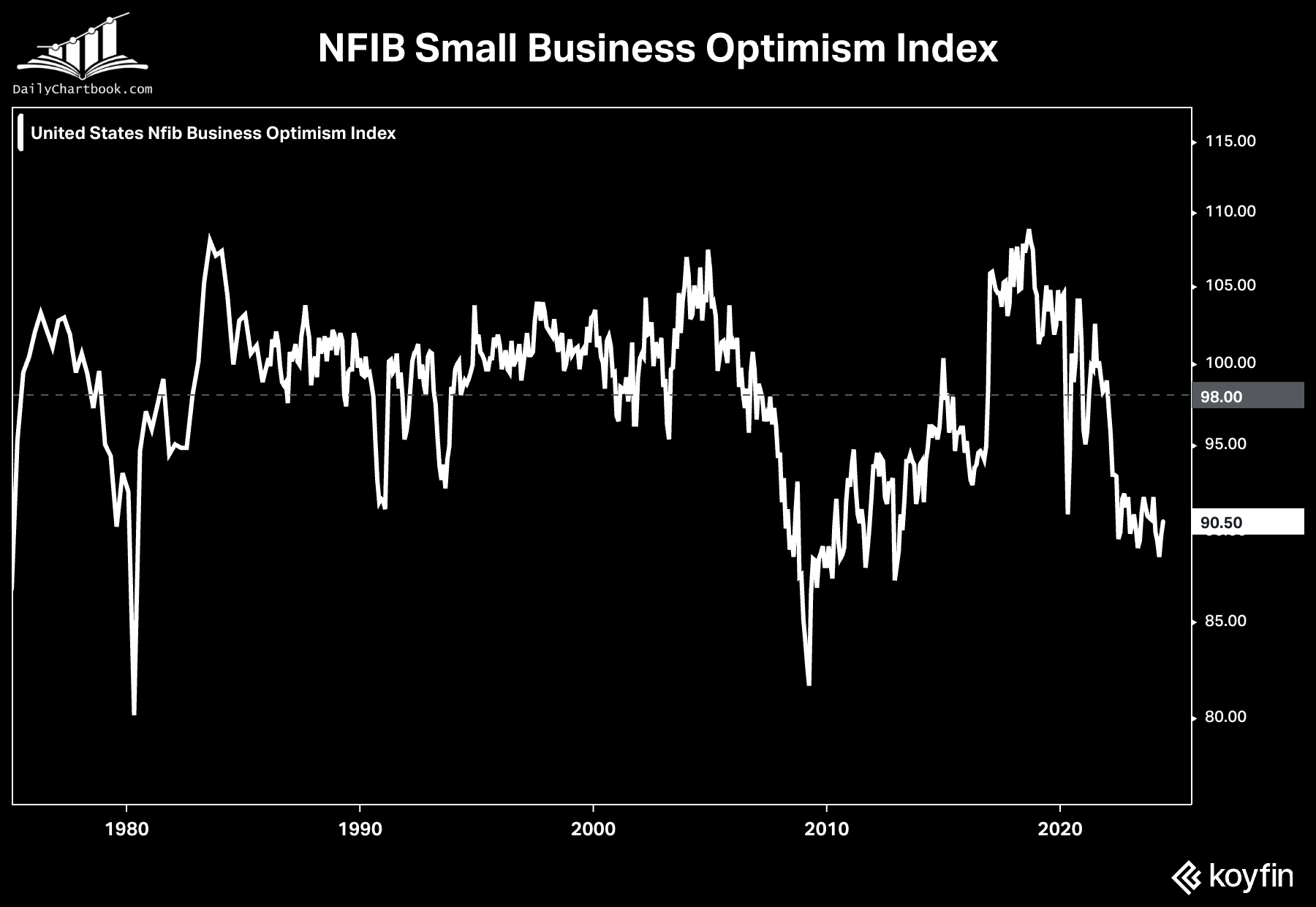

On top of the negative surprises, small business is not confident.

I would argue that in a higher rate environment with competition from bigger companies that small business feels on its heels. While the DOJ has put some pressure on big business, it’s been minimal in most regards, merely trying to undo some deregulation and move towards oligopolies. And, rates aren’t lower yet to make it easier for them to finance themselves.

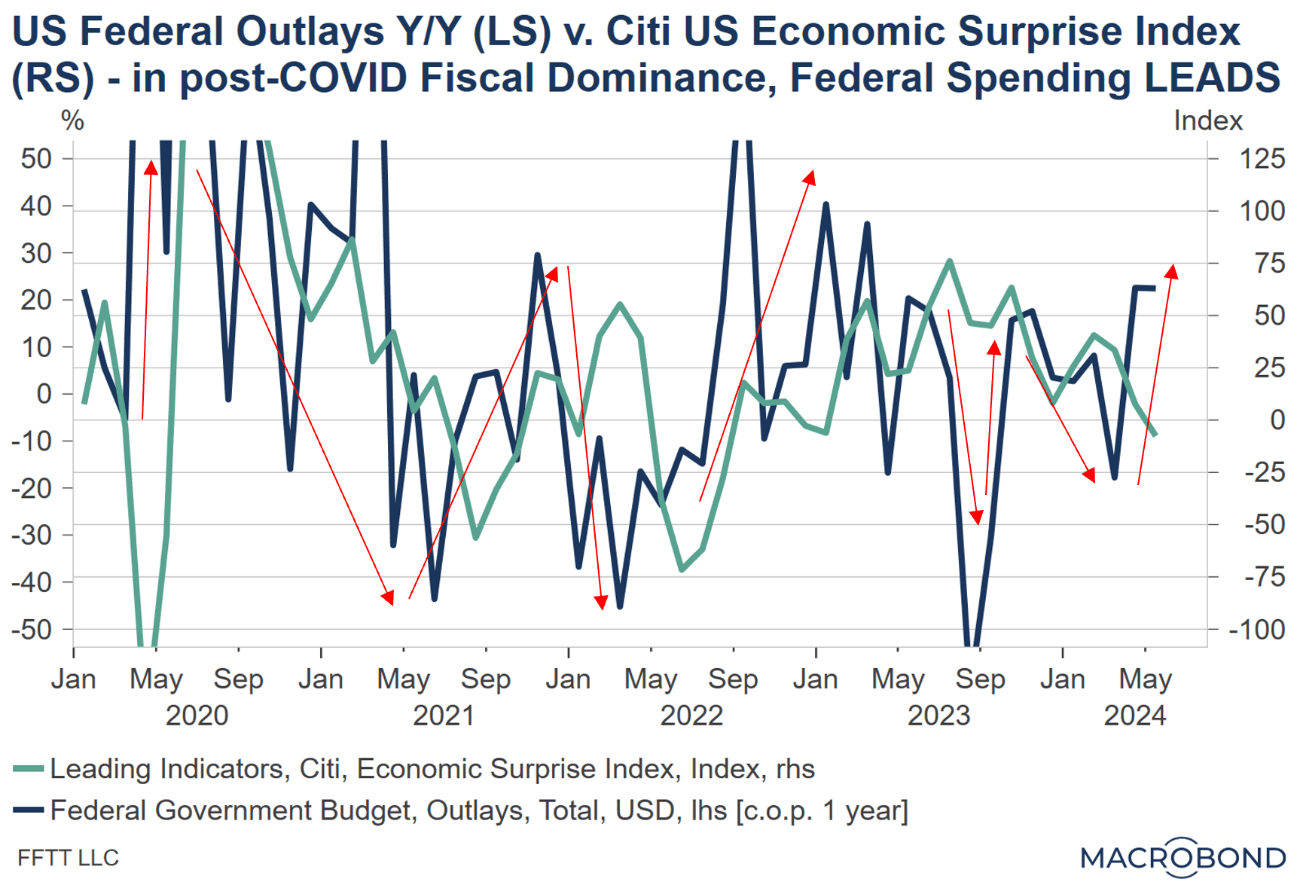

Leading indicators should trend up soon, if rates come down and Federal spending does not collapse.

Banks And Treasuries Mutual Needs

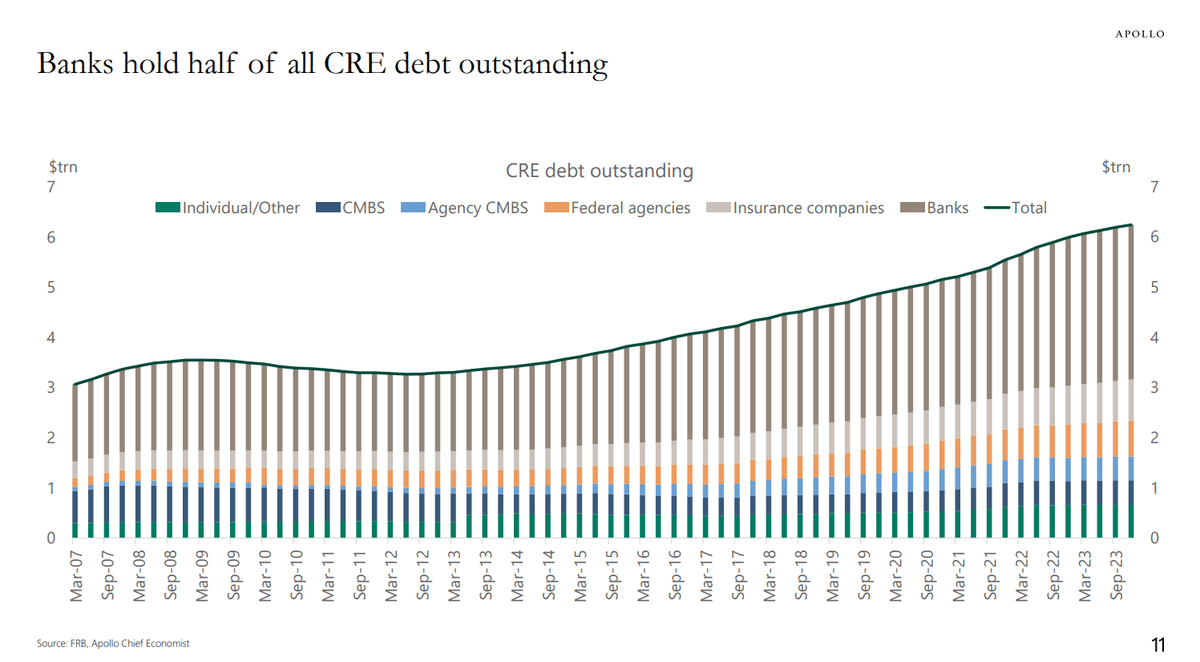

Commercial banks hold about half of all commercial real estate debt. According to the Fed, about 65% of that is held by non-top 25 sized banks, that is, small banks and regionals.

About half of commercial real estate is at risk of haircuts, think flat tops with a buzzer, in the next year or two. We have already been seeing buying of commercial real estate at deep discounts.

The banks need help with that debt in the form of lower rates and capital flexibility because they are not going to be made whole on the refinancing of the notes.

On the other side, the U.S. Treasury needs help with demand for treasuries to allow for an orderly market.

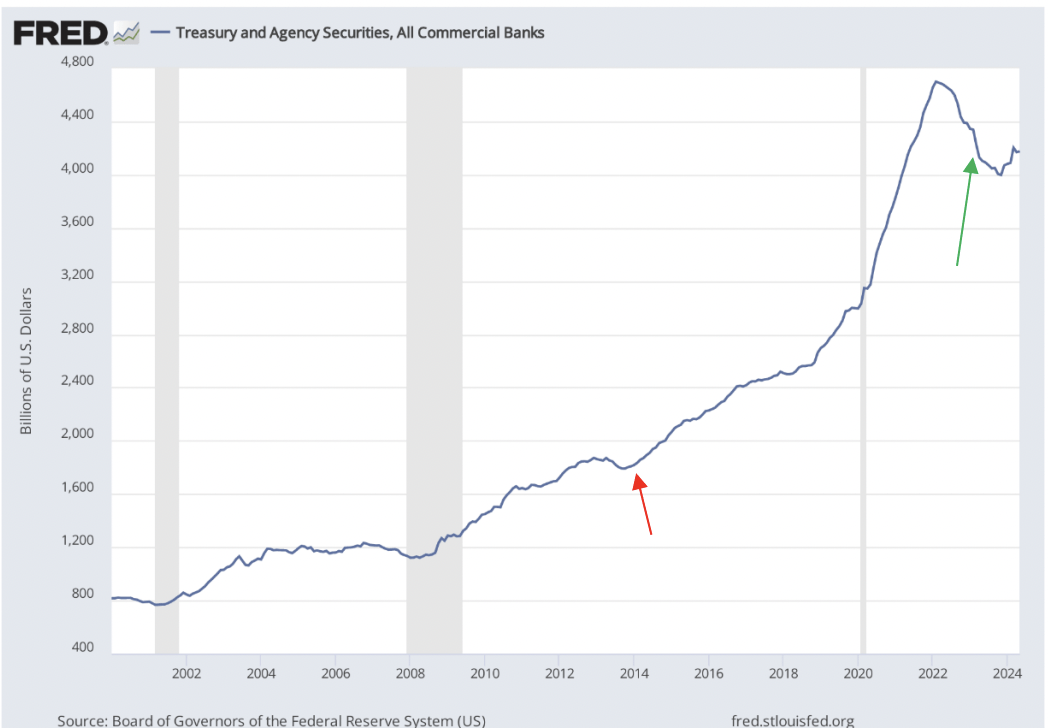

This makes sense since we know that hedge funds have taken a bigger share of the UST market and banks share has declined from peak.

If rates fall, which is what it looks like it going to happen, hedge funds will take profits on their levered bets. There is no guarantee that they will reinvest back into treasuries short-term with rates lower.

That introduces an quid pro quo between the U.S. Treasury and banks, facilitated by the Fed to bring banks back into the treasury market. How so?

- As rates come down, there will be some solidifying in the CRE market.

- Banks will offload loans to new buyers of CRE, but have to take haircuts on their balance sheets, that is, realize what is now currently unrealized.

- If banks buy UST, the Fed considers that “risk free.” The rules already reflect that banks can buy UST to reflect risk free assets and then use those UST to borrow cash from the Fed, solidifying their balance sheets. In essence, the banks can turn “risky” assets into “risk free” assets into cash. It’s smoke and mirrors in my opinion, but, the Fed (sort of) and Treasury print money, so they make the rules.

What occurs is that the banks get a bailout that’s not called a bailout, and the Treasury gets a new buyer of its bonds when it really needs one.

Can “quid pro quo” be by force?

Eventually the buyer of UST will be the Fed itself again in the form of QE, but, that might not be until later this decade. Between now and then though, banks could very well be constrained on loans even with lower rates if crowding out occurs. I suspect some bump in the road will lead to another program to ease lending. We’ll see.

The Debt Requires A Boom

We know that the government does not want to cut spending. Austerity almost always leads to deep recessions or depressions. Look at Greece a few years back, or really any other example. Cutting spending is a decision that we would regret.

Flattening spending is another matter. Peak spending on the Boomer retirement begins in 2029 when the last one gets Medicare. There will be a plateau in spending for several years before deaths slowly lead to falling expenses.

The oldest Boomers are 78 now and will be 83 in 2029. Life expectancy for someone in that age group is about 10 years depending on health.

So, what we can see is that starting in about a decade from now, then for about 20 years before the Millennials retire, the U.S. should have flattish entitlement spending as the Boomer generation starts to shrink.

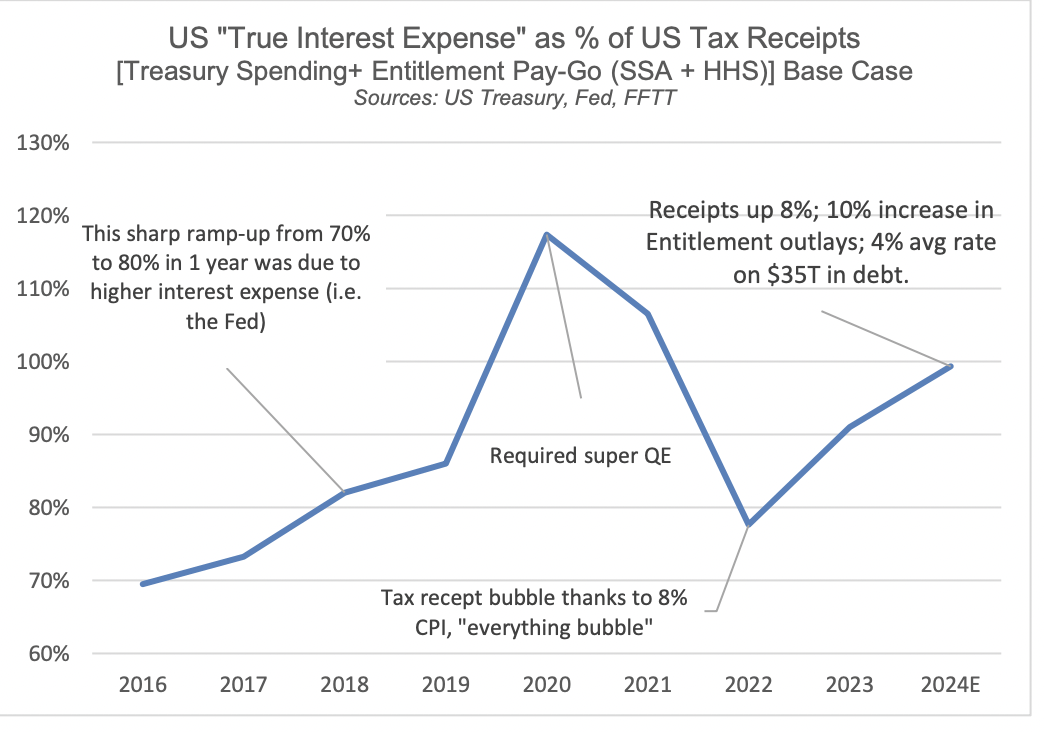

For the next decade though, in order for the U.S. to handle its $35 trillion in debt that is growing by about $2 trillion per year, we will need two things:

- lower interest rates to cut annual deficits by several hundreds of billions per year…

- higher asset prices to drive tax revenues to reduce the deficit further and eventually balance the budget in the middle 2030s.

Any austerity will exacerbate the debt problem by shrinking the economy and tax receipts. A financial crisis would follow and lead to even more QE. Those who survive with assets and cash will do very well after the next financial crisis.

On the other hand, if GDP growth is about a half percent higher, then corporate profits rise, incomes rise and tax revenues rise.

We can stimulate GDP growth with targeted fiscal policy, being reasonable on regulation, monetary policy and allowing enough immigration to offset the Baby Boomer retirements.

We have seen targeted spending on infrastructure, semiconductors and energy by the Biden administration the past few years.

America has a decision in November on who they trust to handle the demographically driven debt issues.

Lower Interest Rates Are Coming Soon

A combination of…

- needing lower rates to reduce UST debt service.

- needing lower rates to support banks.

- needing lower rates to build more housing.

- needing lower rates to help small business.

- needing lower rates to stimulate economic growth.

- needing lower rates to stimulate asset prices.

and that.,,

- inflation is essentially gone.

- employment needs to hold steady.

…means that lower rates are probably coming soon.

Last week Jerome Powell again said that he and the FOMC believes that the Fed Funds Rate has reached its peak this cycle. This means that inflation is not the bogeyman to be afraid of anymore.

Despite the market narrative that quelling inflation requires higher for longer rates, I think Jerome Powell will choose to err on the side of cutting rates soon, likely September, but maybe even July. Already, they are dialing back Quantitative Tightening, aka, QT.

Historically that leads to 6-12 months of a good stock market. It also generally done in response to a looming recession. We will have to pay attention to see if we can maintain the soft landing or if something causes a recession.

Election Uncertainty And The Stock Market

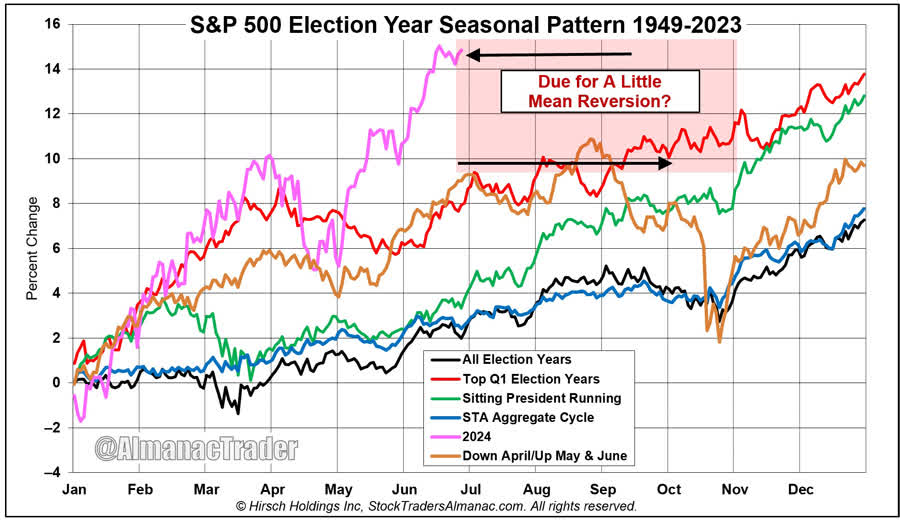

The Presidential and Congressional races are all close despite a recent surge by Donald Trump and issues with President Biden. Here’s what election years look like for the stock market.

What we see is that Q3 gets choppy after about the middle of July. Statistically, we also know that after big run ups there is usually a bit of choppiness or a breather in the upward momentum.

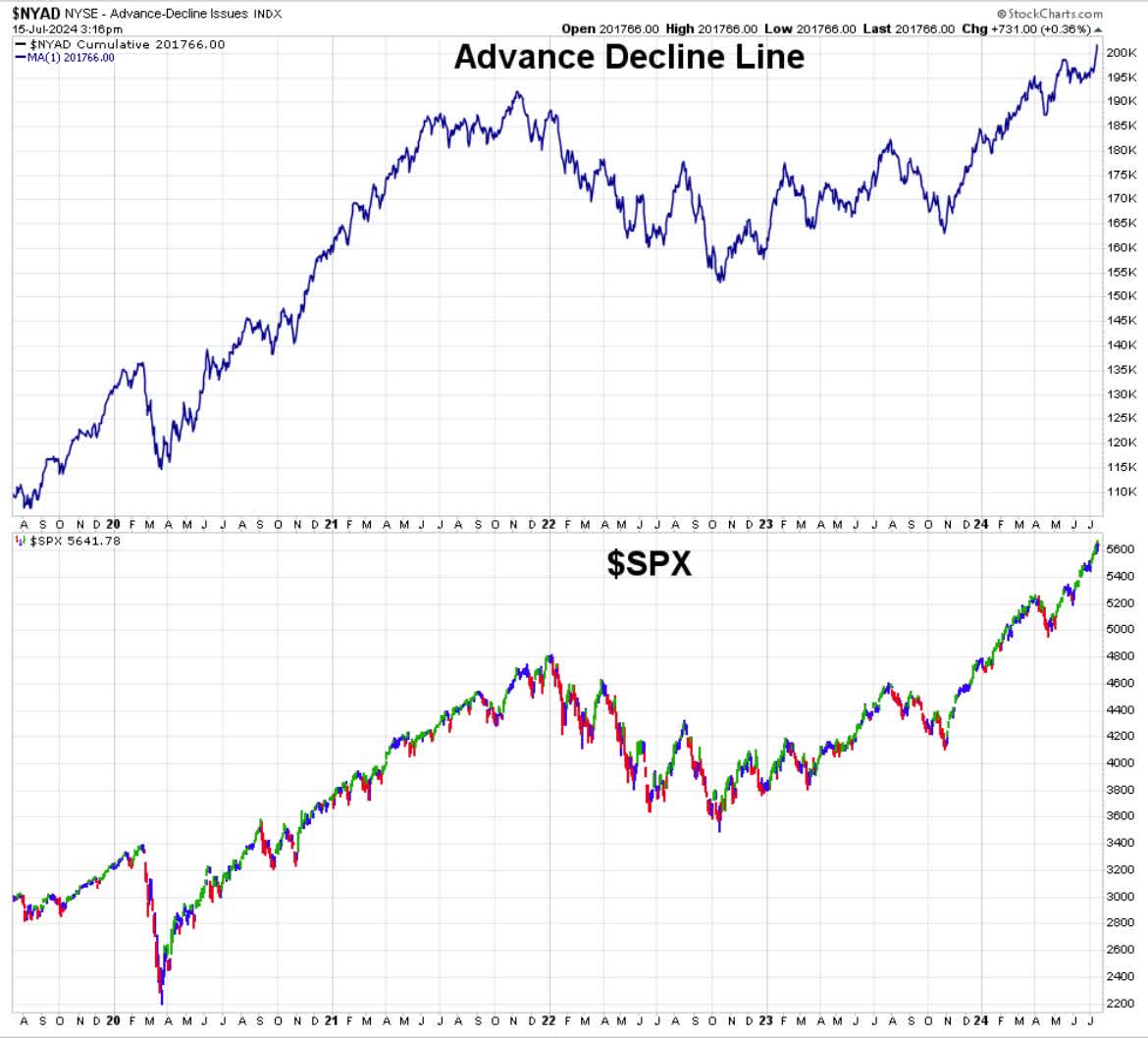

That would jive with this chart.

At the end of 2021 I called for a bear market. I am not ready to do that yet despite the high A/D line. I do think we see some pullback in the next month or two, but then a resumption of the rally into the end of the year and likely start of next year.

After that, we are about 6 months out from rate cuts (presuming they start in September) and stocks would be very overbought by then, with many also overvalued. The second half of 2025 is not setting up to be great right now, but a lot can change by then.

I am holding some extra cash again and even writing some covered calls. But, I am also a very likely buyer on any small correction.

Rate Cut Outperformers

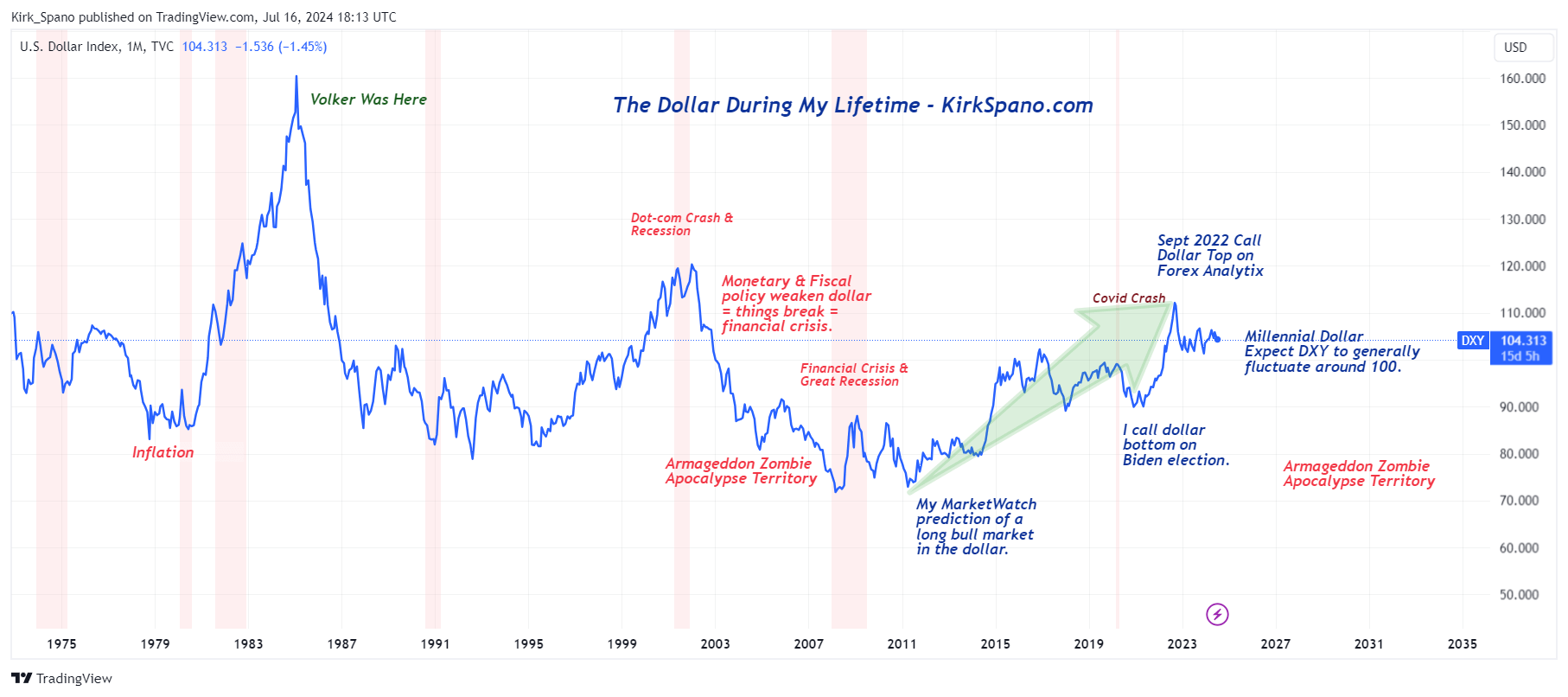

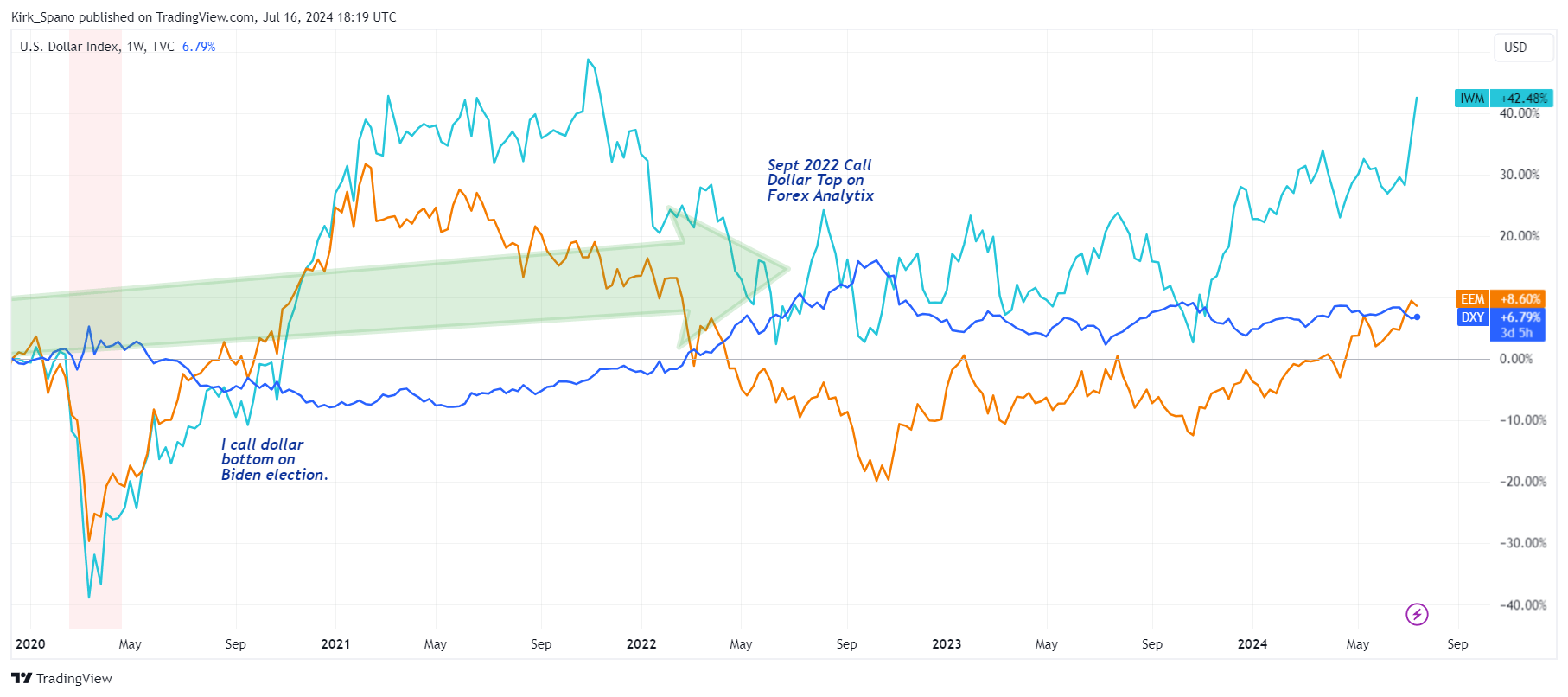

Small caps, mid caps and emerging markets tend to outperform when rate cuts begin. That lasts for variable durations depending on many other conditions. Dollar strength will be important to watch.

TVC:DXY Chart Image by Kirk_Spano

If the dollar stays around 100, standard of living is supported in the U.S. and inflation does not reappear. If the dollar falls towards 90 or below, then expect a resurgent inflation.

As the dollar falls, U.S. stocks lose steam, but emerging markets can outperform.

Indeed, small caps are surging on the hint of rate cuts. Emerging markets have been drifting up since last autumn and likely surge (if history is a guide) if rates see an extended decline.

Bitcoin Adoption Continues

The Bitcoin story remains the same. Nations around the globe are adopting Bitcoin as a dollar hedge to diversify balance sheets, settle certain large transactions (think oil) and limit American hegemony.

Both candidates support it as well. President Biden allowed Bitcoin ETFs and former President Trump has come out pro-crypto recently.

To rightfully be a global currency hedge, not necessarily a currency the way we think about it in our wallets, Bitcoin needs to exceed about 5% of all global currency reserves, likely getting to a low double digit percentage.

Right now, the dollar is over half of all global currency reserves with the Euro around 20%. No other currency is in double digits.

Dollar Dominance in the International Reserve System: An Update – IMF

Global M2 money supply is around $100 trillion across about 180 currencies. I expect Bitcoin to partially take the place of many sovereign currencies on national balance sheets.

In addition, many smaller nations whose currencies carry little international value will start to allow Bitcoin as legal tender. We have already seen that in several emerging markets nations.

OPEC nations are starting to accumulate Bitcoin and have likely, though not fully confirmed, already accepted some Bitcoin as partial settlement for oil.

Bitcoin’s market cap is currently about $1.27 trillion. There’s a long way to go to $10-20 trillion or maybe higher if it is more widely adopted as a global currency as a medium of exchange.

It is not too late to buy Bitcoin.

Closing Investment Thoughts

I think we should look for stocks to continue to rally after a brief breather this summer. It also makes sense that market breadth expands to include stocks not in the Magnificent 7 plus a few other mega caps.

There is also the wildcard that Democrats replace Joe Biden as their Presidential candidate. If they do, I see that as very stimulative for the stock market. You see, either the stock market likes the new candidates, or, it accepts a Trump victory. Either way, stocks do well, at least in the short run.

My prediction at New Year for the stock market was for the S&P 500 (SPY) to rally to 5,720 by year-end and for small caps to rapidly catch up once rate cuts happen. This is the quarter where a lot more comes into focus.

A Permabear Sees A Rally, Angst And Euphoria In 2024

So far, we have gotten the rally. Angst has been mild at most though.

If I am right about a rate cut soon, then that rally could spread to a lot of the unloved sectors of the markets.

- I continue to like Bitcoin (BTC-USD) and linked ETFs like the iShares Bitcoin ETF (IBIT).

- I have recently warmed back up to certain REITs after a 2-year hiatus and will cover my favorites in July.

- I am maxing out my small cap allocation as they historically do very well with falling rates. More to come on that soon, but see my recent piece on micro caps.

- I am also bullish on energy with power demand increasing at record rates. I wrote about it here.

A final note. I believe that all investing is “relative investing.” So, while many stocks will continue to go up in a falling rate environment sans recession, I think a lot of S&P 500 large cap favorites are setting up for a major correction in the next year or two. I also think the Boomer retirement crisis is a lot closer than people think right now. A lot more on that to come.

Next year, one way or another, the story starts to change.

Author

Kirk Spano

CEO/CIO — Fundamental Trends

Kirk is an Accredited Investment Advisor and founder of Fundamental Trends and Bluemound Asset Management LLC. Kirk has been highly successful in helping DIY investors make sense of the investment world, and profit in stocks, ETFs and crypto.