Summary

- The Federal Reserve, Jerome Powell in particular, seems to want a Goldilocks soft landing scenario and is trying to get things just right.

- Fed got a two-year stock market round trip that allowed valuations to come down a bit.

- The risk to the economy is not lower rates and inflation, but higher rates allowing things to soften too much.

- A higher stock market means more tax revenue for the debt laden government.

- Market breadth does not support a decline in stocks yet, I’m sticking with my 5700 S&P 500 call for the year.

evin Dietsch/Getty Images News

Jerome Powell’s post FOMC meeting press conference was full of some great snippets. I thought they spoke for themselves. But then, I read a piece from Logan Kane on Seeking Alpha titled “Powell And The Fed Are More Hawkish Than You Think: Expect Economic Weakness Ahead.”

Logan’s central thesis was that to prevent an asset bubble and reignition of inflation, the Fed was acting more hawkish than he thought they would. Well, I have two thoughts about that I will cover below.

Logan did get plenty right though, especially that “people are not doing a good job of pricing risk.” Thing is, that’s not uncommon. Most people don’t understand the risk of overspending on a car instead of saving extra in their retirement plan.

How can folks be expected to know that Tesla (TSLA) might still be overvalued despite a 2-year 50% correction into a $56 billion executive pay package, or that Nvidia (NVDA) has a half dozen deep pocketed competitors only 2-3 years away from seriously challenging them? They’d have to read a lot. Who has time for that when there’s red and green numbers on a choice of dark or light chart backgrounds with confetti animations for buying your first meme stock?

In a world of lower stock market leverage and half of folks indexing, the chronic mispricing of risk is not an economic stability risk of the sort we saw in 2007. It probably does lend itself to more extreme extremes in volatility and price though, both high and low. What it is not though is an economic stability risk. And, I will actually be a monkey’s uncle if the Federal Reserve thinks it is.

The Fed Already Got Their Correction

Logan’s idea that the Fed wants to see a stock market correction, I think, is pretty far off. If you care to look back, I talked about the Fed wanting to see a correction in late 2021, right before they tightened. That’s when they were looking for a stock market correction.

The Fed Warned You, Are You Going To Fight The Fed?

That was one of a batch of articles that got me called a “permabear” by some of the magical Voodoo trading system guys. Sort of funny because I’m also the guy who said 5700 on the S&P 500 (SPX) this year.

A Permabear Sees A Rally, Angst And Euphoria In 2024

The reality is that the Fed got the correction they wanted.

2-years No New SPY Highs (Kirk Spano)

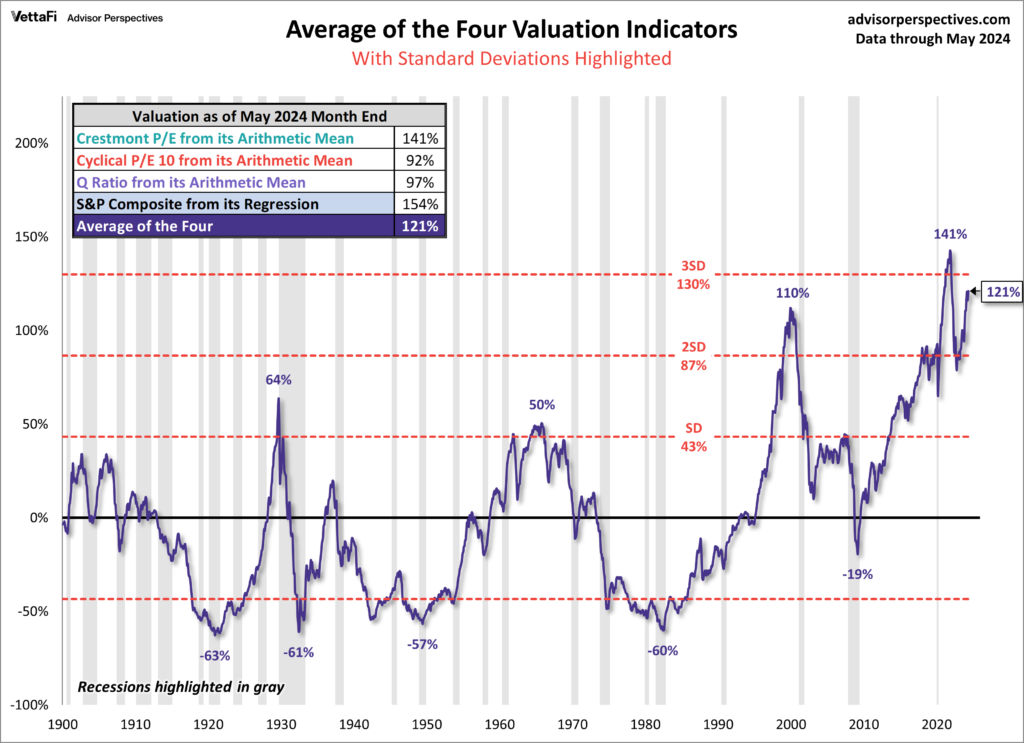

And, valuations are a bit lower too.

Average Of 4 Valuations (dShort Advisor Perspectives)

That’s not great, but it does go to my point above that extremes are more extreme in a world of indexers and narrow market breadth. Remember, narrow market breadth means most stocks aren’t doing great.

It does not take higher rates to cause a correction in a small basket of super sized mega cap winners. It takes competition doing well and investors measuring risk well. Of course, we know that second part won’t happen, so, they’ll probably scream really loud when the big money dumps the big stocks to buy the competition, and they just don’t know why their stocks fell. And, they’ll blame other people for their pain.

A Note On Real Estate

By now, we all know two things about real estate. One, there’s a residential real estate shortage that began about a decade ago. Second, office real estate is still taking it on the chin from the long-term impact of Covid.

One of the questions in the presser related to real estate prices. Powell made a point of saying that lower rates would help with the housing shortage, but that there’s been a housing shortage for ten years, and we were going to have a housing shortage for a while.

He’s spot on with that from what I can tell from my side hustle trying to work with developers on residential developments and observing my fiance’s real estate practice.

The current rate environment means two things.

- developers are having a hard time getting adequate internal rates of return on projects, so, many projects are sitting on hold.

- homeowners are, especially Boomers, are not moving as much with mortgage locked in at sub 4% rates.

I thought Powell was trying to say that he would like to lower rates to help housing, and the banks on navigating commercial real estate, but he wasn’t very clear. I’ll be waiting to hear follow up on that because I think it is important.

What I did not hear at all was a concern that lowering rates a quarter point or two would cause home prices to rise. It seemed to me he was fine lowering rates to help housing if it didn’t cause higher inflation elsewhere. I’ll wait to hear follow up on that in coming weeks. But, I got the impression he wants to lower rates, that is, I thought he was pretty dovish in that exchange.

Higher Stock Prices Mean More Tax Revenue

Once when Janet Yellen was Fed Chair, she replied to a question about ultra-low interest rates causing bubbles with “aren’t higher 401k balances better?” Or something to that effect. I remember watching it. I’m pretty sure it was mid-2017 as the “sell vol” chant was growing louder. If someone can find the actual exchange, that would be great.

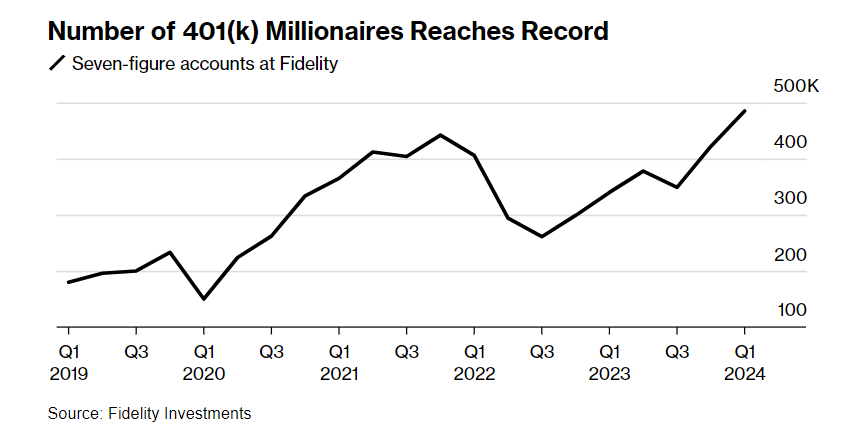

Jerome Powell talks to now U.S. Treasury Secretary Janet Yellen with regularity. Guess what 401k balances are doing now:

401k Millionaires (Fidelity)

In a nation with a debt problem, can you think of a legitimate reason why the Federal Reserve and government would want 401k balances high? It’s a pretty easy question to answer. More tax revenues to pay the debt.

I don’t think this is really speculation as it’s been talked about for a long time, but, I think that asset price inflation is part of a two-step approach to inflating debt away.

For the 60% of folks with no net assets, the whole inflation thing sucks. For folks who don’t qualify for the carried interest tax credit and will get their retirement plan savings eaten by taxes someday, it’s not great.

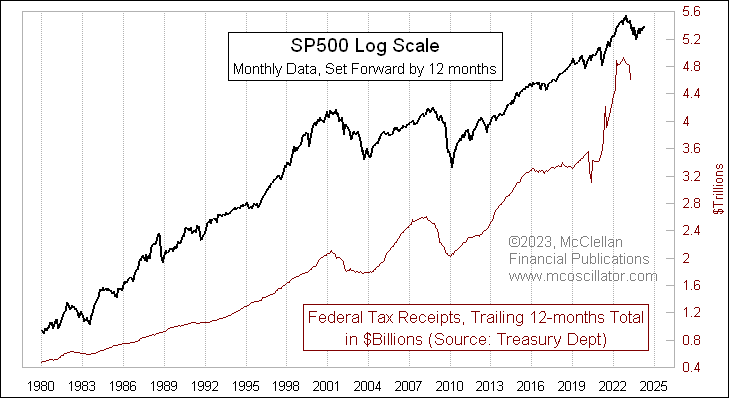

But it is what it is. And this correlation is pretty convincing:

Stocks Up, Tax Revenue Up (Tom McClellan)

Not Powell’s Plan “For Things To Break”

People who follow me know that I have suggested that the Fed lower rates in July without committing to a new cycle, as a way of fortifying the soft landing. At one point in the presser, Powell had an exchange with Jennifer Schonberger of Yahoo Finance. Schonberger asked, “Why not cut rates this summer, just once?”

At about the 48-minute mark, Powell gave an answer that he understood the risks of slowing the economy in the face of making sure inflation wasn’t resurgent. In one slightly exasperated part of his reply, he said, “that’s not our plan to wait for things to break and then try to fix them… we’re trying to balance these two goals in a way that is consistent with our framework, and we think we’re doing that.”

That doesn’t sound hawkish to me. It sounds like he wants to lower rates, but, needs just a little more reason to do so.

We have to consider the psychology here. It could be that Powell doesn’t want to be wrong about waiting too long to lower rates, after having many people say he was late to raise rates (I’m not one of them).

Or, it could just be that he knows more than us about what’s up the road, and he has a plan to invite Goldilocks in just before the storm clouds really start to gather.

The Economy Is Landing Pretty Soft

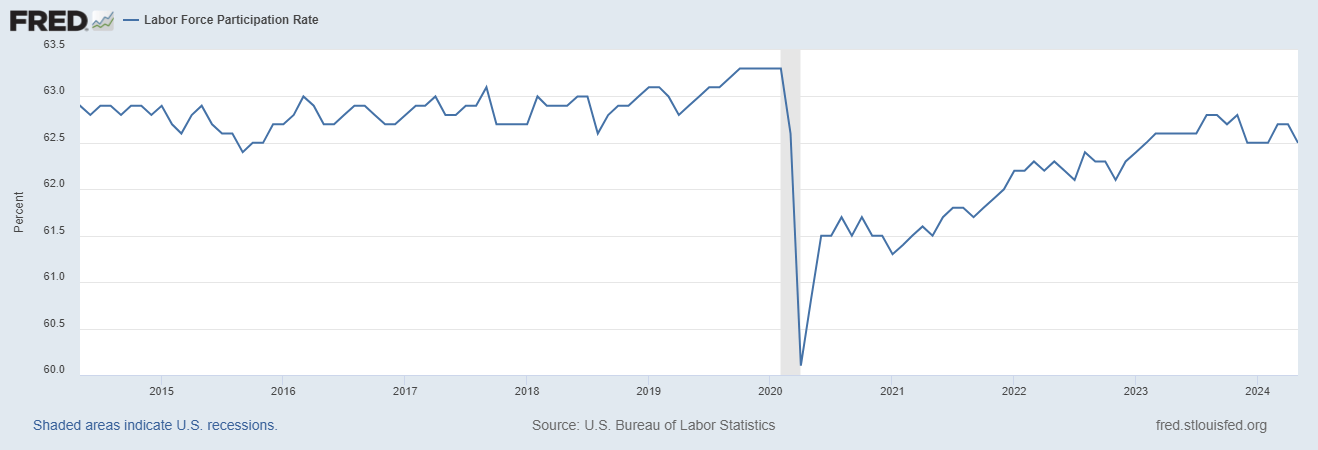

Right now, we have an unemployment rate of 4% and the labor participation rate had been rebounding.

Labor Participation (FRED)

I’m not sure how to interpret the immigrants in the workforce. I think we continue to see large revisions in employment numbers.

Common sense tells me that we are seeing an impact in the flattening wage rates, which are helping bring down inflation. I think that alone might be enough for the Fed to cut in either July or September.

With CPI already printing lower just before the Fed meeting and PCE coming soon, we might get all we need by early July for the Fed to cut in late July.

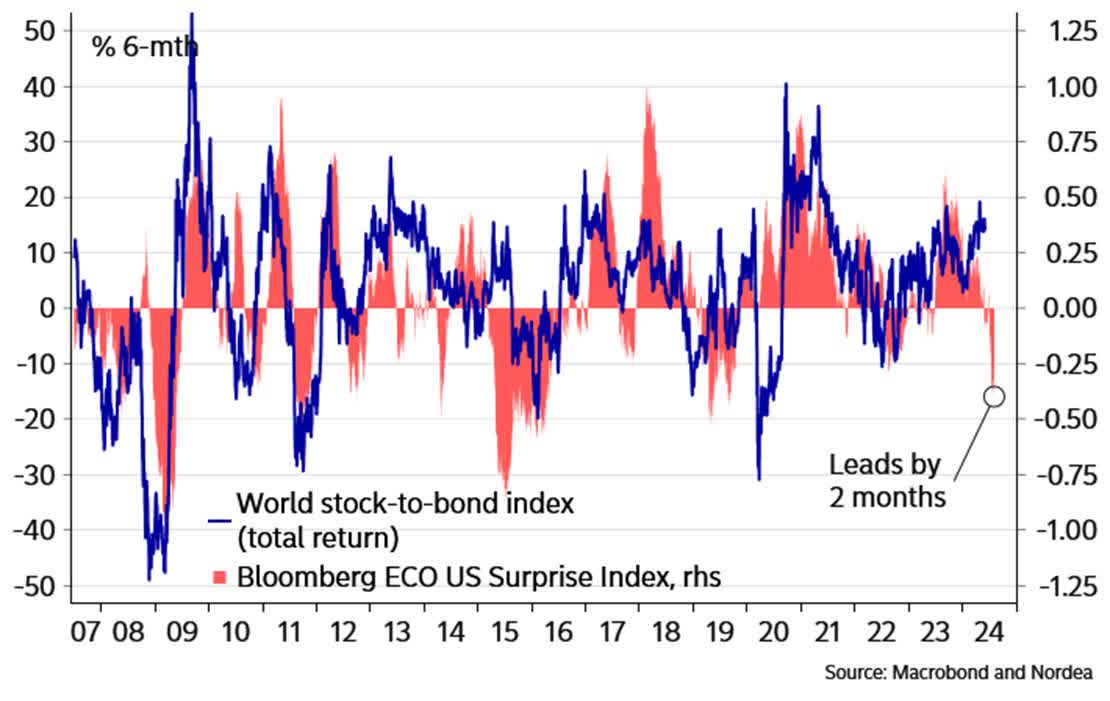

Another thing that could prompt a cut is that negative surprises in the economy have been stacking up.

Negative Surprises (Macrobond, Nordea)

I think the Fed is well aware of this.

The Bottom Line

I’m not too worried about anything short-term in the economy. Yet.

And, I did not come away with a Fed that was afraid to cut rates, rather, they want to get the timing right. They want Goldilocks to spend some time with them. I do not think the bar is very high anymore for a rate cut.

Maybe the things everyone is looking at to trigger rate cuts is not on many people’s radar, with the focus always being inflation. If I had to guess, I would think a potential event is a bank failure that required similar action as last spring. We’ll see.

I was just at the Hart Energy Super Dug Oil & Gas conference and got to listen to 2-time Acting Director of the CIA speak. He is quite concerned about a terrorist attack in the United States, potentially this year. That would be a horrible shock, but, it would probably not be horrible for the economy or stocks for too long.

The stock market has a lot of tailwinds for now too. But, as we shift into a late cycle expansion, which I think clearly we are doing, I would expect breadth to widen. Once it expands enough, that’s when the “stock market” aka S&P 500 will start to sputter.

Go back and look at the end of 2021. There was a big widening of breadth that signaled the end of that bull market. We’re not there yet. I’ll stick with my 5700 S&P 500 target for the year.

Author

Kirk Spano

CEO/CIO — Fundamental Trends

Kirk is an Accredited Investment Advisor and founder of Fundamental Trends and Bluemound Asset Management LLC. Kirk has been highly successful in helping DIY investors make sense of the investment world, and profit in stocks, ETFs and crypto.