Expect A Looser Federal Reserve Soon

Interest rates are not high.

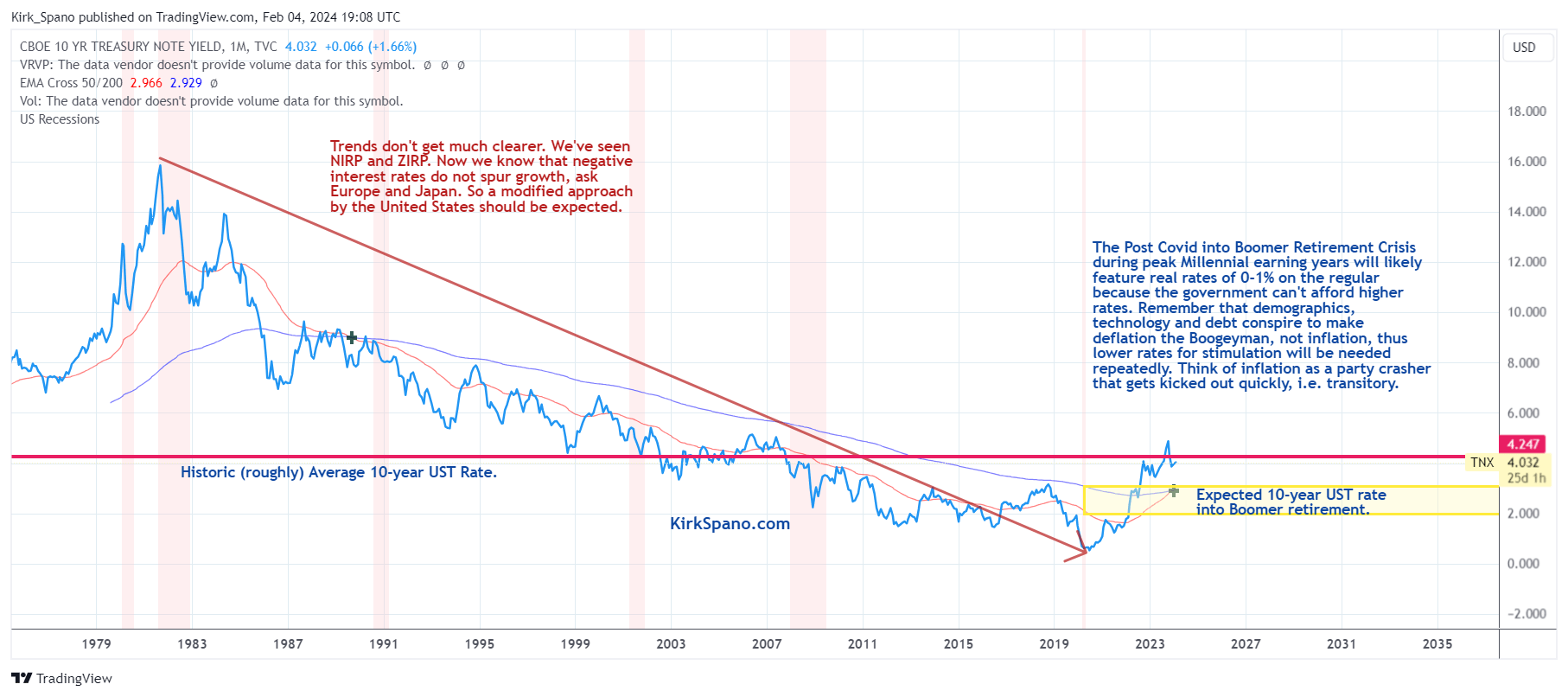

According to MacroTrends, the post World War II average 10-year U.S. Treasury rate has been 4.25%. Today, the 10-year U.S. Treasury rate is 4.02%. A shade below average.

In response to a question about a potential rate cut in March at the recent Federal Reserve meeting, Chairman Powell stated that “I don’t think it’s likely that the committee will reach a level of confidence by the time of the March meeting to identify March as the time to do that.”

Welcome to “The Great Normalization” by Jerome Powell.

Today, I will discuss Federal Reserve policy within the context of the short-term and long-term economy, as well as, potential impacts on asset markets. This piece will serve as a foundation for a discussion I will have going forward in my periodic “Macro Dashes” pieces that have appeared on Seeking Alpha.

Historic 10-Year U.S. Treasury Rates

Here is a summary of historic U.S. interest rates for context.

During the post World War II period, U.S. interest rates were fairly low, commonly between 2-4% in the 1950s and early 1960s. This made sense as the world rebuilt itself and the U.S. sought to grow coming out of the devastation of World War II.

By the middle 1960s, rates started to rise on inflationary pressures brought by high growth, the Vietnam War and increased government spending on social programs.

During the 1970s, the U.S. abandoned the gold standard and faced oil shocks. Both contributed to rising inflation that was met by rising interest rates.

From my viewpoint, the oil shocks were the primary driver of the “stagflation” that hit in the late 1970s and early 1980s.

In 1979, Federal Reserve Chairman Paul Volcker undertook an aggressive policy that saw rates peak in September 1981 at 15.32%.

That resulted in back to back recessions in the early 1980s as Congress and the President struggled to find solutions to stagflation. I lived this period seeing many family and neighbors lose jobs. Financial suffering throughout society was noticeable everywhere. Stagflation has been my key fear for the economy since. I wrote about it here on Seeking Alpha:

Macro Dashes – The Fed Could Cause Stagflation Next

With rates peaking in 1981, rates began a choppy decline that would last for nearly 40 years into Covid. That marked an extremely long, generational bull market in U.S. Treasury bonds.

10-year UST rates fell to 1.35% in July 2016 following the Financial Crisis and then for moment in March 2020 during Covid fell below 1%. Since then, rates have risen relatively quickly.

Transitory Inflation

The rise in interest rates since 2020 has largely been tied to Federal Reserve policy meant to head off inflation. During this period, those who believe that long dead inflation was the boogeyman to beware have taken a victory lap.

But, as I described in a different Macro Dashes piece on Seeking Alpha, the inflation was likely to be transitory.

Macro Dashes – Inflation Is Transitory, Most Prices Are Permanent

Plunging inflation rates the past year support my view that the real long-term boogeyman is deflation. I have made that argument since my MarketWatch days during the post Financial Crisis period. I have called the period we are in now and for the foreseeable future, the “Slow Growth Forever Global Economy.”

I wrote about “Slow Growth Forever” here on Seeking Alpha back in 2016.

Understanding The ‘Slow Growth Forever’ Global Economy

Investing In The ‘Slow Growth Forever’ Global Economy

Supporting the idea that inflation was transitory I would guide you to the Fed’s favorite inflation indicator the PCE or Personal Consumption Expenditures index.

With PCE down to 2.6% year-over-year it seems that inflation, excluding any potential future shock, has returned to the more “normal” rates around 2%.

Tom Lee from Fundstrat, one of the few analysts to really nail last year’s bull market, has noted that month-over-month inflation rates are indeed falling even faster the past 6-months with an implied rate of about 1.6%.

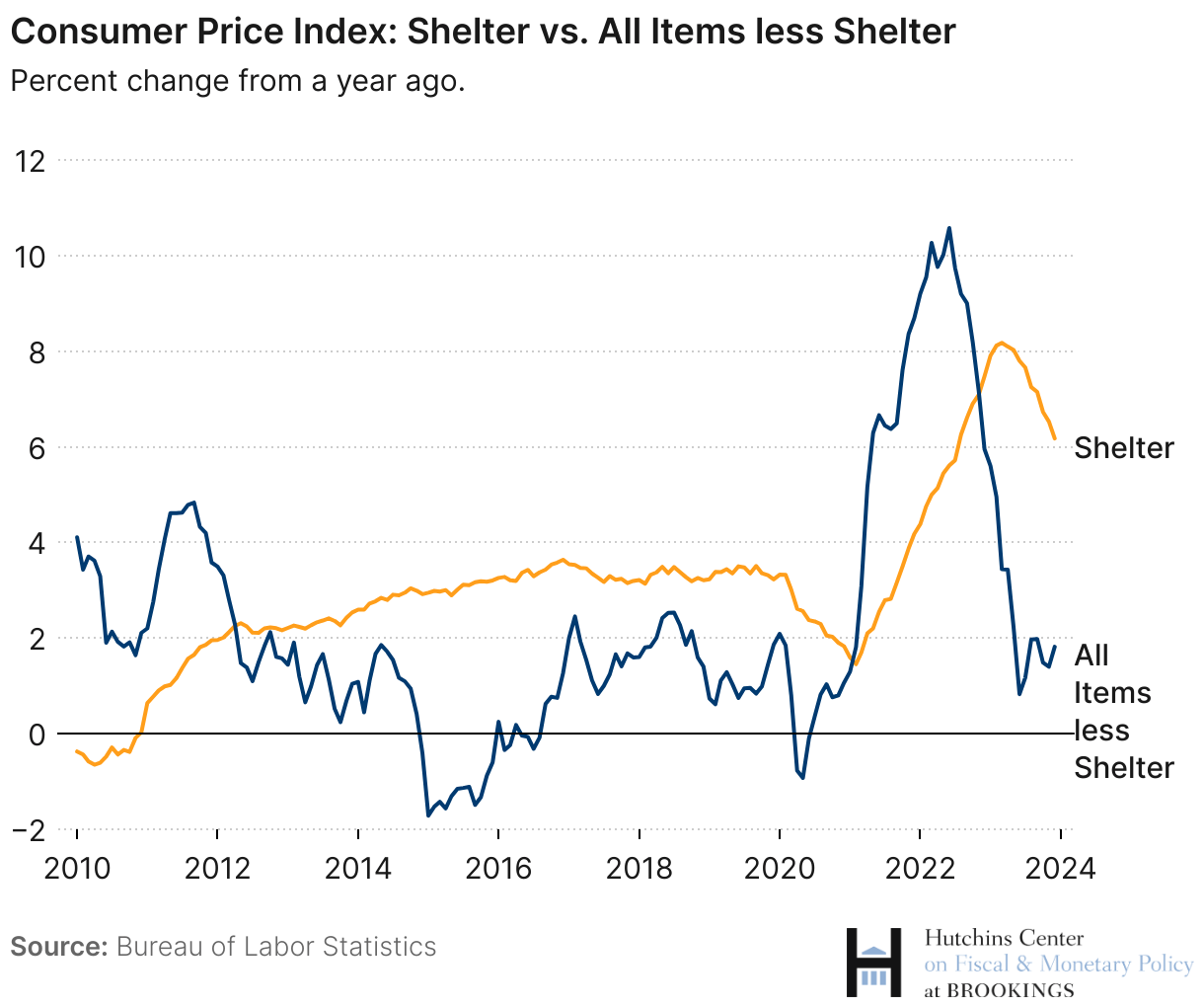

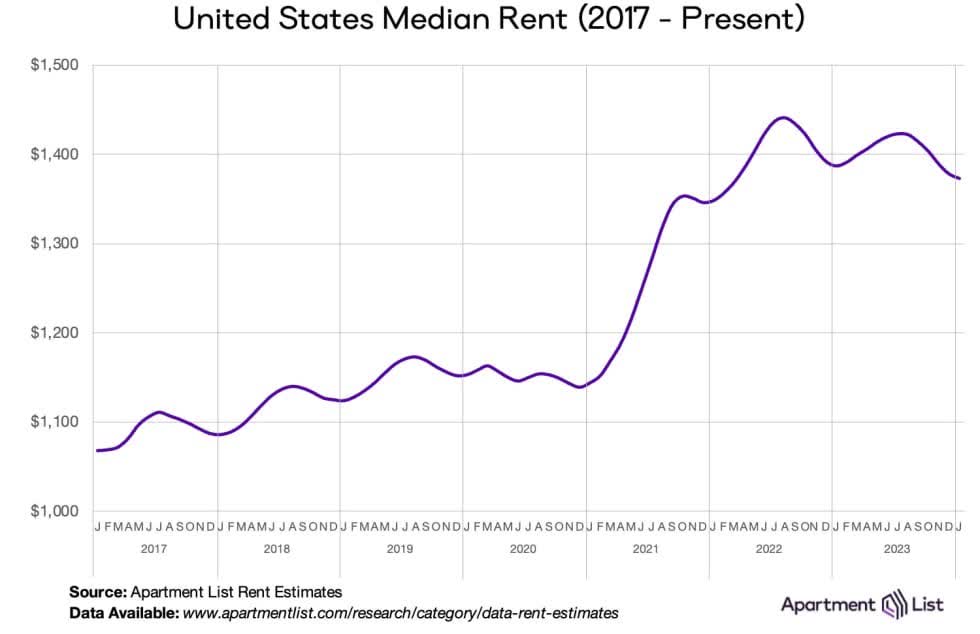

We can see that housing and auto insurance are among the primary drivers of remaining inflation.

In the December CPI, auto insurance inflation was 3.6% and accounts for 20% of core CPI, which floated much of the Core CPI higher.

Housing of course remains in shortage, but even the inflation there is turning over. Housing represents about one-third of CPI.

With a record number of rental units coming on in 2024, the trend should at least not accelerate back up and potentially continue down.

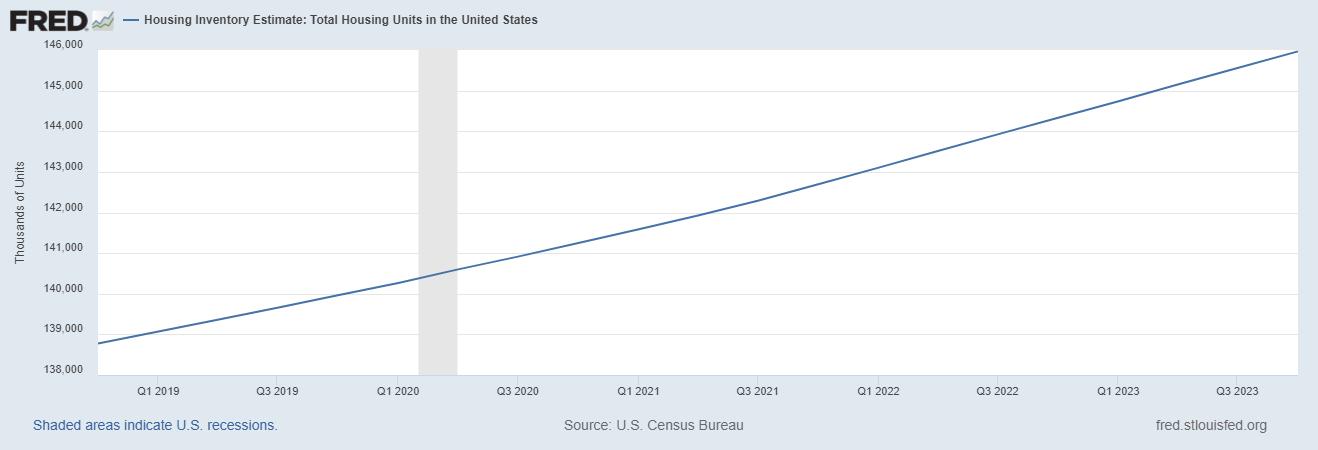

New home construction has been steady as well.

Shelter prices seemingly starting to turn over support the idea that the housing shortage is slowly dissipating, which, if that continues would be a significant catalyst for continued lower inflation.

The Logic Of Falling Inflation Amid Normal Rates

With interest rates normal, I think we need to do a thought exercise as to why inflation is falling so fast. It does not follow that normal interest rates should be restrictive to the point of crushing inflation. Something else must be going on.

Most people operate within the confines of their most recent memory. That is just human nature.

In 2020, we saw what was essentially a heart attack to the global economy from Covid. We can argue whether it should have been a heart attack, but why bother, since, it was. Global GDP cratered deeper and faster than any other time in history including the Great Depression. That is an economic heart attack.

The defibrillator for the heart attack was a massive amount of global fiscal and monetary stimulus. In and of itself, fiscal and monetary stimulus are by definition inflationary.

The inflationary policy response to Covid combined with supply chain shocks and constraints on oil supply, by OPEC and Russia, to introduce more inflationary pressures in 2021.

By 2021, we started treating Covid like the flu. Americans just weren’t going to stay in and many got vaccinated. This unleashed a wave of “revenge spending” that ignited the tinder of stimulative and supportive money that had been spread around. Much of the rest of the world followed the American lead in 2022 adding to inflationary pressures as economies rebounded.

As we see, just a few years later though, inflation is back to about normal, and interest rates never really got above the historical norm. In Japan they are just now toying with the idea of leaving behind ZIRP (zero interest rate policy).

So, why didn’t it take significantly higher interest rates to lower inflation?

I think the answer is relatively obvious and supports my “slow growth forever” thesis. There are key factors contributing to deflationary pressure on the global economy that offset the inflationary pressures. Let’s look under the hood.

- Aging demographics are hitting all of the developed economies to a certain degree. Japan is the oldest, followed by Europe, then China and the U.S. With age comes dependence on social programs as people retire from their earning years. This problem is not confined to the 4 largest developed economies. Nearly half the emerging markets in the world are also suffering from high social welfare dependance driven by aging demographics and other factors (war, bad economics, lack of resources, etc…)

- Technology has proven to be disinflationary over time despite growth surges near the beginning of adoption cycles. What will we see with AI over the next generation?

- Global debt continues to grow. According to U.N. studies, even creditor nations are facing strains as they grapple with what to do with non-performing debt. Squeezing debtors exasperates suffering, while debt restructuring often destroys capital and appetite to finance more development. There are no easy answers and we are all remembering our lessons from macro econ 302 describing “crowding out” about now.

Those factors lead me to one conclusion: Deflation, not inflation, is the bogeyman. That is why it only took “normal” rates to break a bout of party crashing inflation.

Overcoming Deflation

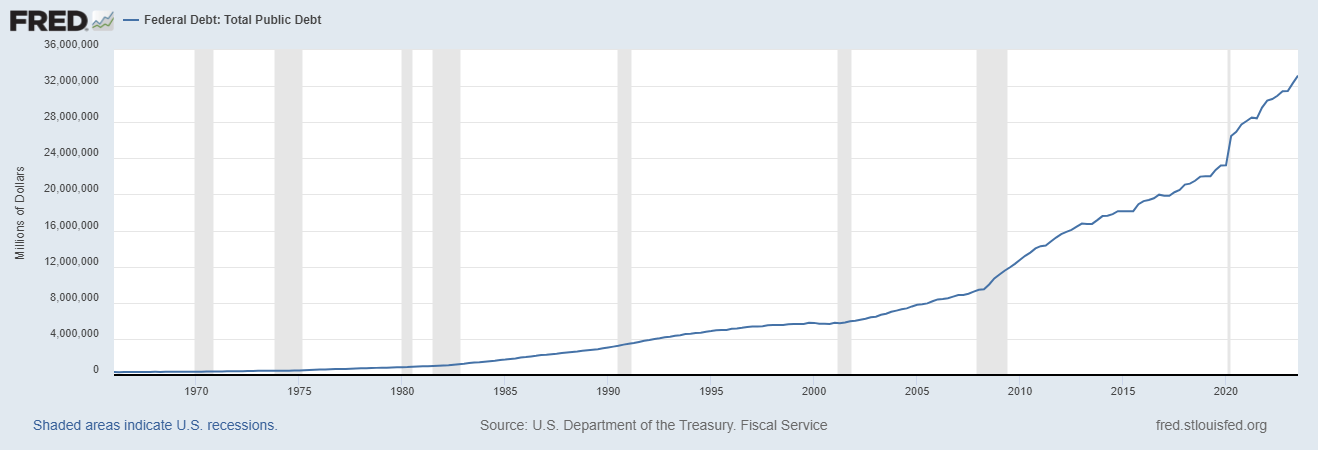

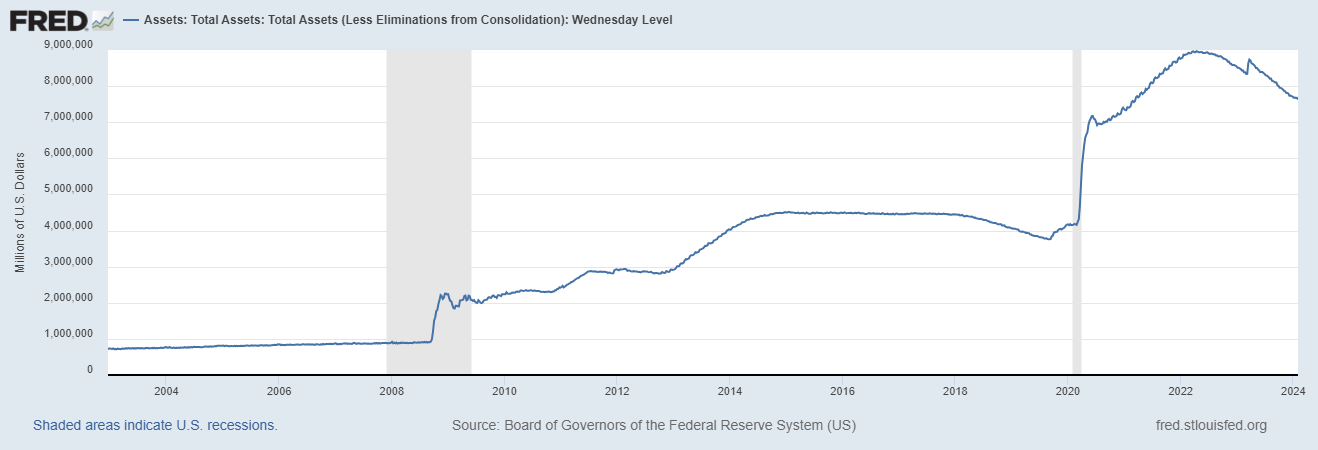

Since the Great Depression, the Federal Reserve has used counter-cyclical policy to offset recessions and stimulate back to growth. Beginning with the Financial Crisis though, we have seen more counter-cyclical policy than ever before. Both the fiscal debt and Federal Reserve’s balance sheet’s have grown astronomically.

U.S. Federal Debt (FRED)

With those charts in mind, I would offer than we should not be thinking in terms of counter-cyclical anymore, but rather “counter-secular” policy.

It is clear we are dealing with something bigger than cyclical economics. “Slow growth forever” and massive social welfare obligations anyone?

I mentioned Japan above for a reason. They are the blueprint for what is coming to U.S. policy. You have by now heard the word “Japanification.”

I think that’s about right, but, with U.S. specific modifications that recognise America is not nearly as fragile economically as Japan.

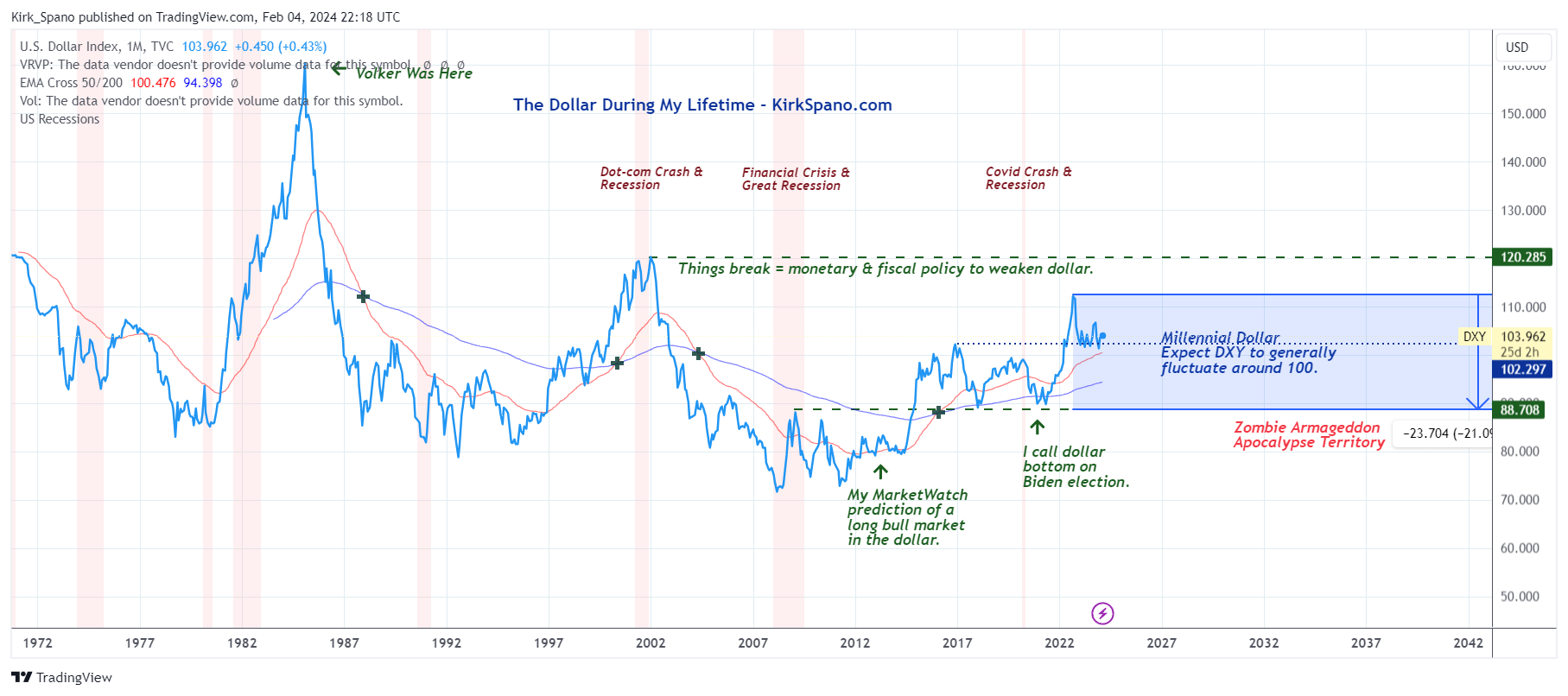

The United States is resource rich, technologically advanced, allows immigration (even if it is haphazard), is globally diversified financially, benefits from the rule of law and has half the planet’s military might. Those are all the same reasons I gave on MarketWatch back in 2012-3 to expect a dollar bull market which did in fact occur the past decade.

Given the coming deluge of Boomer related retirement costs, how will the U.S. pay for it? I think the answer is clear. We will borrow from ourselves using an ever expanding Federal Reserve balance sheet. We have had QE, QE2, QE3, QE Repo, QE Covid and soon we will have “QE Forever.”

As unappealing as that might sound, I would direct you to look at Japan. They’ve been able to maintain their standard of living despite not having nearly the economic strength of the United States, and, in fact, seem to be coming out of it fairly well. There’s probably a reason that Misters Buffett and Munger invested over there several years ago.

The prospect for QE Forever is also why talk of a depression is, well, silly, naive and just maybe self-serving to those slinging magical voodoo trading systems.

Why would we choose depression over saddling our Great Grandkids with some debt? I won’t argue the ethics of this, because, well, it’s complex and difficult, rather, I’ll just point to human nature again. If we can kick the can down the road 30 or 40 or 50 years, we will. Why? Because…

In the long run we are all dead.”

John Maynard Keynes

What Will “QE Forever” Look Like?

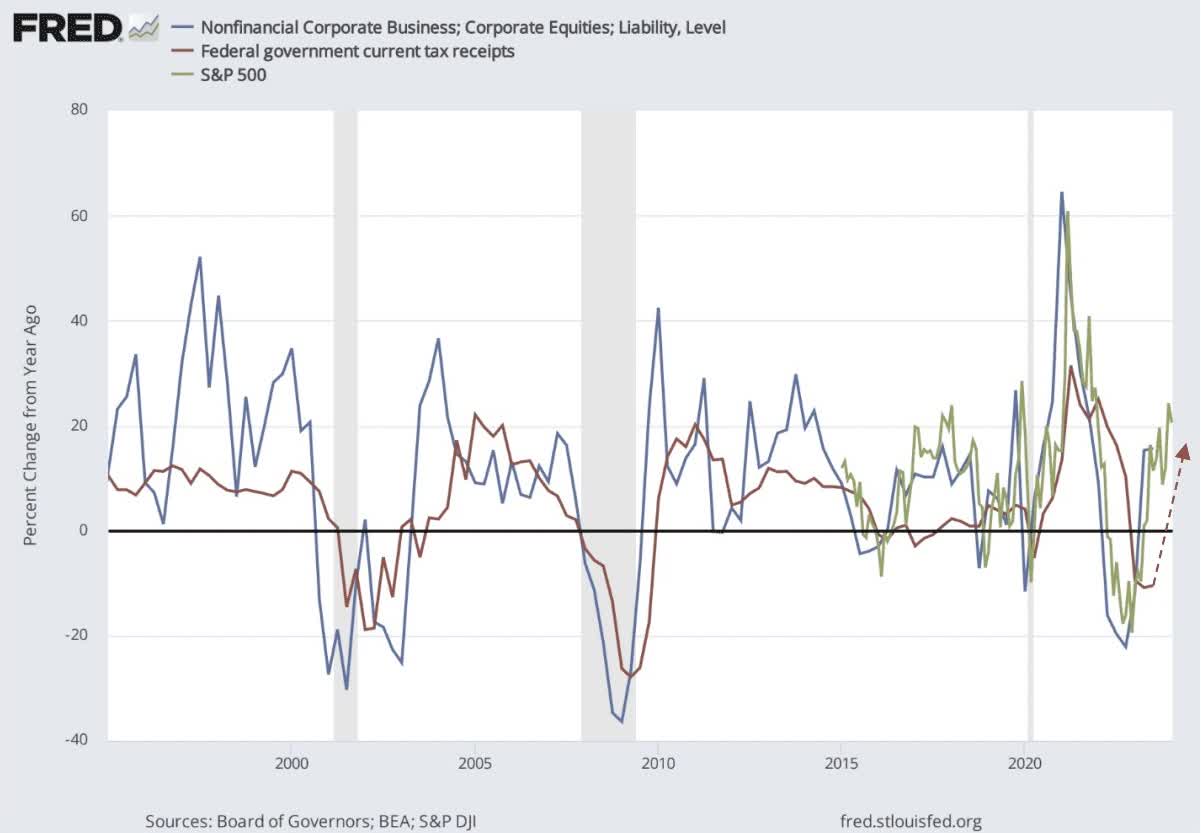

Recently, UST borrowings have both come in below estimates by analysts. But, they are still huge. Why did the borrowings come in lower than expected? A rising stock market.

I note this because I have been saying to members of Margin Of Safety Investing forever, that the Federal Reserve and U.S. Treasury have a very motivated interest in seeing asset prices rise.

A rising stock market stimulates higher tax payments which reduces the amount of borrowing necessary. And, since the stock market generally rises over most 3-year rolling periods and about three-quarters of individual years, well, tax receipts should rise too more often than not.

There is also the very real possibility that the tax code is changed to collect more revenues from the very wealthy and when people die. Think abolition of most carried interest and the step-up in basis above a certain amount of inherited wealth.

That’s wonky, but, it’s important to know that we do have relatively low taxes right now and that is likely to change whether it is in the next 4 years or not. So, unless you are in the top 1% or maybe 2% [me] on the income scale, slightly higher taxes are likely good for you because those tax receipts will support your Social Security and Medicare payments.

We can not expect the stock market to rise year-over-year forever though. There will be negative years, but, politicians love a crisis, so, they’ll spend money on the fiscal side during those periods.

Over the next 30+ years, until the demographics even out around mid-century, you will see a rinse and repeat cycle of fiscal and monetary spending in a way that offsets the massive secular trends driving deflationary pressures. And, it’ll probably work out just fine, like it did in Japan, unless we freak out and start killing each other, because, well, we’re human.

I don’t want to be morbid, I am in fact an optimist about the future. I repeatedly say that things have gotten better generation to generation since the Dark Ages. History clearly shows that is a correct statement. It is fact.

Ending QT Into The CRE Mini-Crisis

The first step to the next wave of QE (Quantitative Easing) is to end QT (Quantitative Tightening). In the last Fed meeting, Powell stated this little nugget:

“Not a decision that we’ve made, but I wouldn’t think we’d be—we wouldn’t be taking a position that it’s got to go to zero, I mean, if it—if it were to stabilize at a different level. But that’s not a decision that we’ve made. That’s what we’ll be talking about at the March meeting. A whole range of issues will be briefed up and the committee will get into—get into all of the issues that will be arising over the course of the next, let’s say, year or so.”

What a weird thing to say. He implied that QT might stick around for a while. But, that the Fed members will be talking about it in March. Previously he had suggested that QT would start to be reduced this year.

Here’s where I want to weave in the slow rolling, about to accelerate, banking crisis being caused by commercial real estate.

I covered in my 2024 forecast that there was about half a trillion dollars of holes about to be blown in to bank balance sheets due to non-performing commercial real estate loans. That’s far smaller than the residential real estate crisis in 2007-10. To avoid regurgitation, I strongly recommend reading the following for context:

A Permabear Sees A Rally, Angst And Euphoria In 2024

With members of Margin of Safety Investing, I have suggested that the Fed will taper QT, but also, create another “special facility” (don’t call it QE) to support that banks.

In other words, I see the Fed doing QE and QT simultaneously by different names. The net result for the next year could be a flat Fed balance sheet.

The Federal Reserve’s Bank Term Funding Program [BTFP], deployed when SVB, First Republic and Sovereign bit the dust last year, is scheduled to stop on March 11th. But, as we saw last week with New York Community Bancorp (NYCB), bank stress is not gone yet. I would argue the Fed will need another half trillion in a program like BTFP this year.

Finally, let’s remember what QT is. It is the Fed reloading its bazooka for next time. I would argue the reloading is almost done.

Macro Dashes – The Fed Is Reloading Its Bazooka For Next Time

Stocks & A Looser Federal Reserve

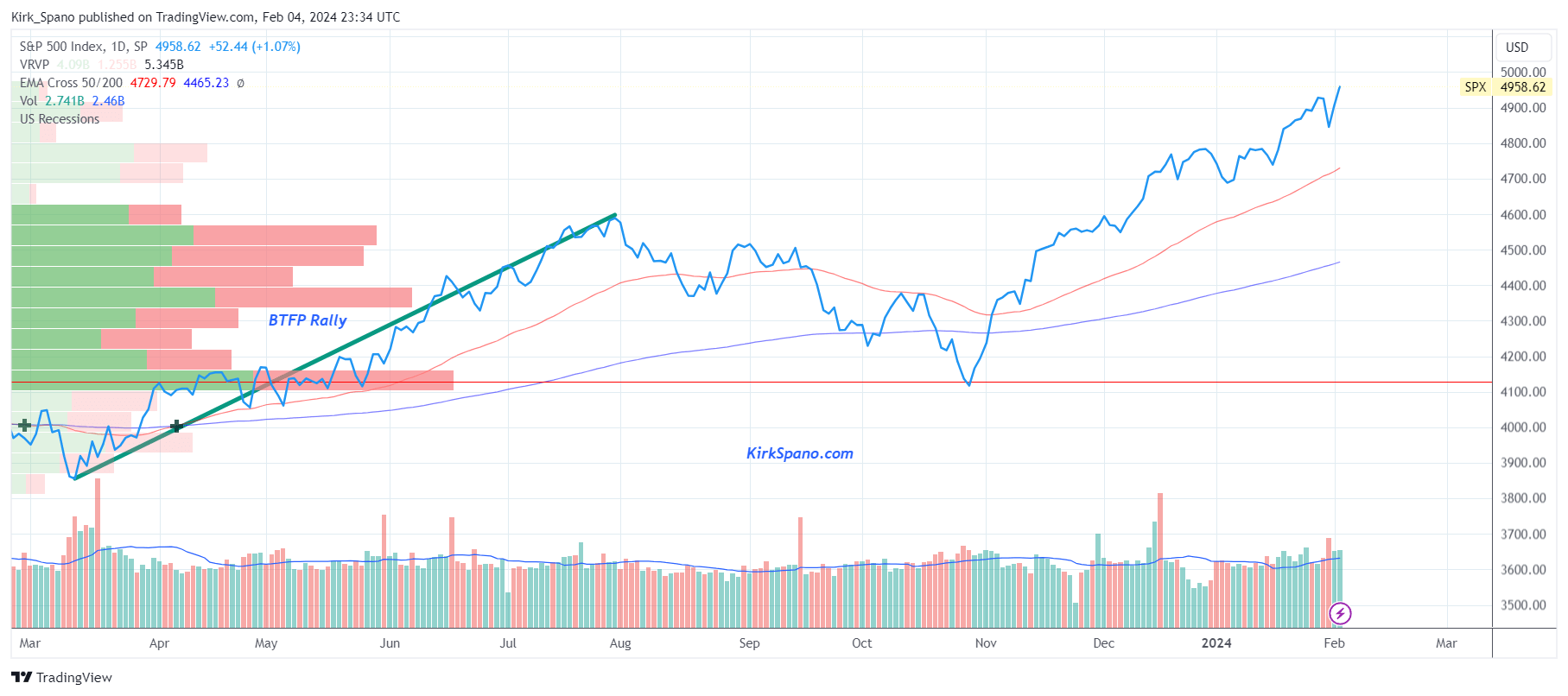

When the Federal Reserve started the BTFP last March, we saw a rally begin almost immediately that last into late summer. After a brief pause, the rally resumed despite QT continuing.

So far in 2024, the stock market has reached new highs in line with the rally part of my 2024 forecast. I would expect some angst soon.

I am not indexer since there are demonstrably better ETFs than the SPDR S&P 500 (SPY) and Vanguard S&P 500 (VOO) ETFs, but, in general, I think you can buy the dips on both in coming weeks.

Author

Kirk Spano

CEO/CIO — Fundamental Trends

Kirk is an Accredited Investment Advisor and founder of Fundamental Trends and Bluemound Asset Management LLC. Kirk has been highly successful in helping DIY investors make sense of the investment world, and profit in stocks, ETFs and crypto.