Summary

- Market Breadth is expanding and has a ways to go.

- The S&P 500 is closing in on a bubble top but is not there yet.

- Small caps and emerging markets offer some interesting opportunities as rates come down.

- Stock and ETF selection are more important than ever.

Analysts, investors and the punditry across television and the interwebs love to talk about bubbles in the stock market and economy. They also love fake equivalencies that make them sound smart and their ideas sound presciently scary.

Here’s the problem, the idea of bubbles in the economy and markets is mostly wrong, or at least, early. There are elements of truth for things to worry about, but for now, relatively speaking against the past hundred years, things seem pretty good.

Folks flapping their gums and clacking their keyboards about an “everything bubble” are just looking for attention, because, you know, any publicity is good publicity. The data does not support an everything bubble – yet.

In our nearly constant state of cognitive dissonance, it is hard to live in the now and still look forward. It is easy though to make bad decisions with bad information. Using bad information badly and being not good at being forward looking are what most investors fail at.

A lack of being able to truly look forward causes most non-indexers to trail the indexes. And, it’s why about half of people now just give up and index up until the time they panic sell near bottoms (plenty of evidence of this for another day).

Here are my simple messages today: the stock market is not in a bubble. Not the S&P 500, not small caps and certainly not emerging markets.

But “They” Say It’s A Bubble

Yes, I know “they” say it is a bubble. But, “they” generally are selling something and trying to stay relevant despite mediocre skills. There are a few exceptions like Jeremy Grantham whom I take very, very seriously.

Some of the headlines and Reddit posts are wonderfully amusing. You can almost hear the bass line underlying the chanting, foot stomping and chest pounding. It’s wonderfully melodic.

For your perusement…

I think “The Fed Pricked the Everything Bubble” is to my way of thinking. That is, I think the Federal Reserve, by raising rates and engaging in QT, caused just enough of a bear market in 2022 to buy the bubble blowing more time. I talked about it here among other places:

JPOW, In The Fed, With A Blunt Tool, Just Killed TINA).

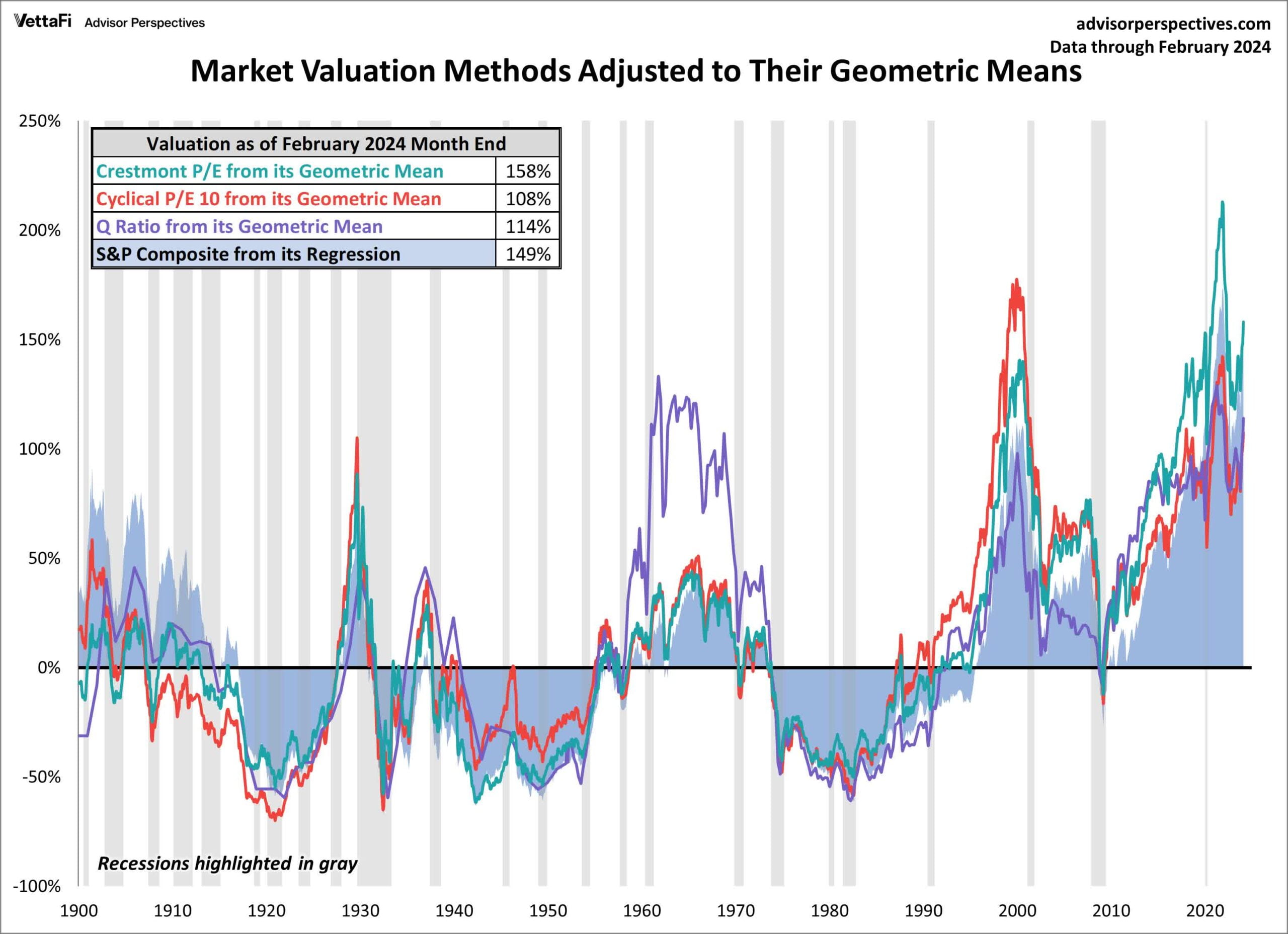

The S&P 500 Is Not In A Bubble

And, what is “it” that the bubble applies to? For most folks it’s “the stock market” which to them means the S&P 500 (SPY) (VOO), not the other 5000 stocks on stock markets.

From the chart above, what you can see is that the S&P 500 is not back at bubble levels. Not yet anyway.

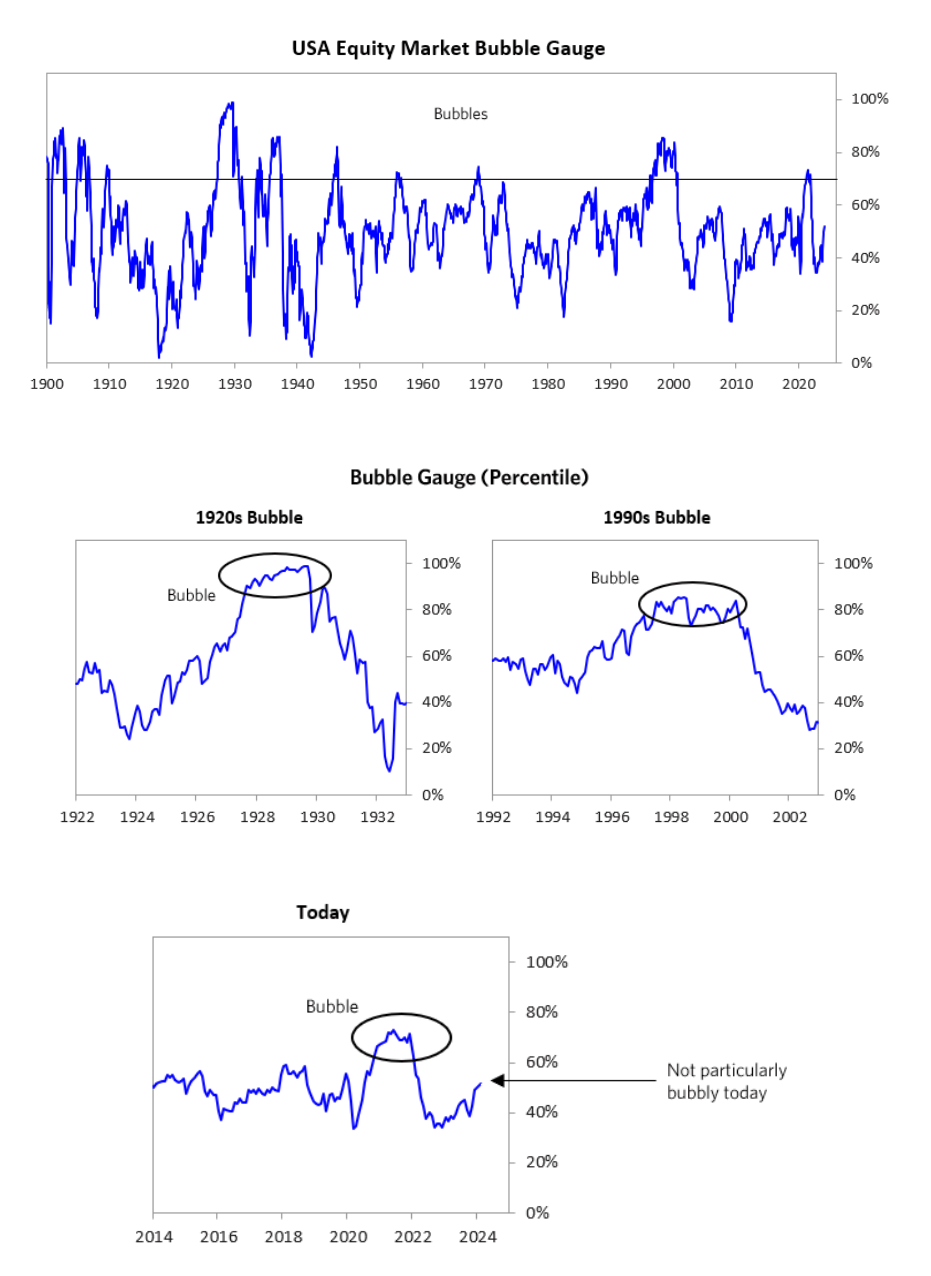

Ray Dalio has his own bubble gauge that Bridgewater uses. He recently posted this.

I think this supports that while bubbles might develop, so far, we are not seeing it just yet.

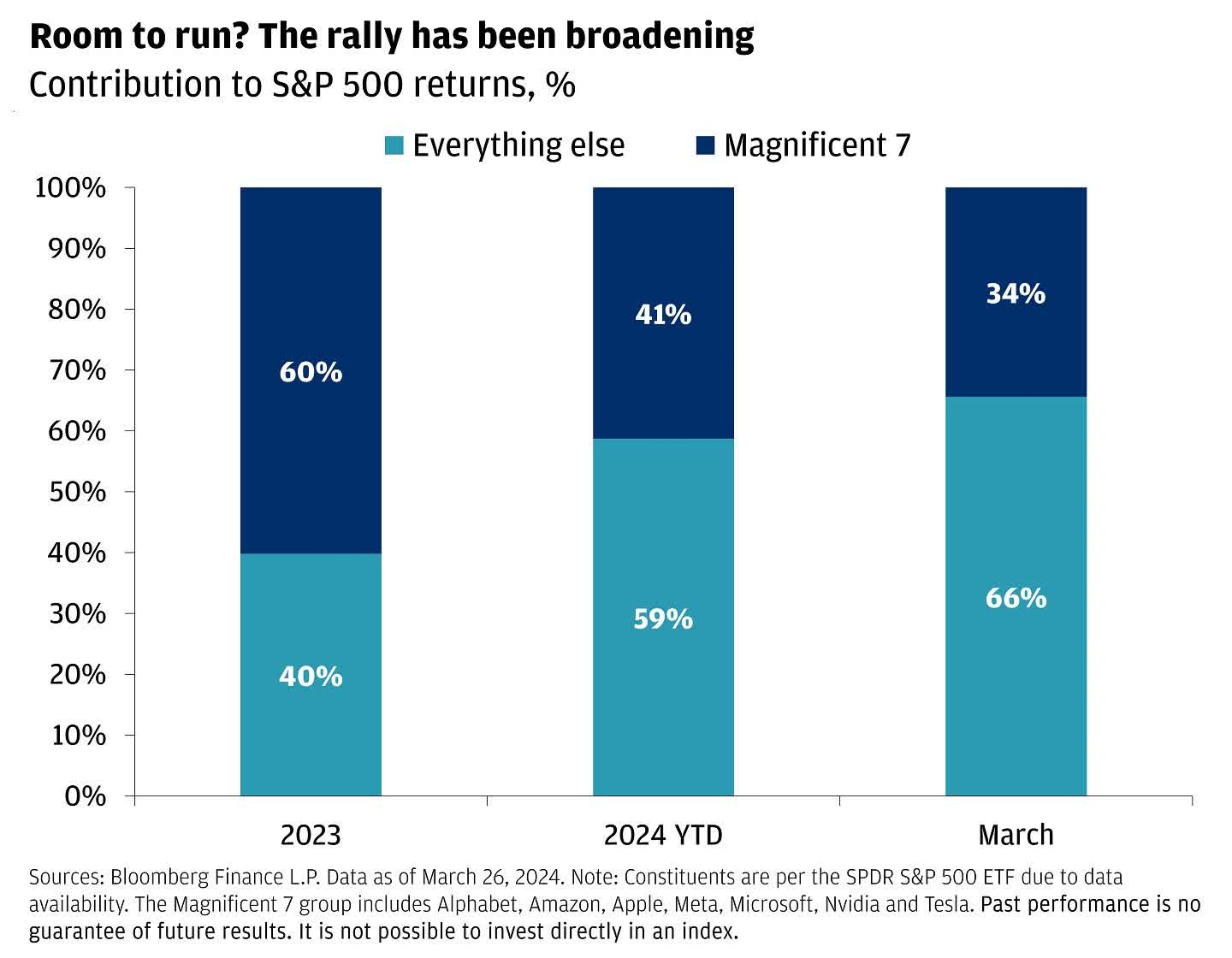

J.P. Morgan (JPM) also just put out a chart that I think tells the story of the rest of 2024.

I think it is telling that market breadth reached 80% over the past few weeks which indicates wider participation in stock gains. I think it also foreshadows an end to those gains about a year out, like the end of 2021, when market breadth exceeded 95%.

It is healthy that concentration would dissipate. If we can avoid a recession and in fact have the soft landing, it would be great. Another chart from J.P. Morgan to highlight.

I have been in “team soft landing” for a couple years now, so, we’ll see how it works out. I have an opinion of which way things go depending on who wins the Presidential election, but, that’s for another article.

Remember, at the start of the year, I said this:

A Permabear Sees A Rally, Angst And Euphoria In 2024

So far, we’ve seen a rally in 2024. I suspect we see angst in Q2 at some point that lasts at least several weeks, but then, well, I think we see euphoria baby. But, for now, we are in bubble blowing mode, but the bubble, at least according to valuations, has not expanded to the point of exploding.

The Indexer Reality On Stocks

S&P 500 index investors now make up about half of all the money going into stocks. As many famous investors have discussed, from David Einhorn to Jeremy Grantham, plus little old me, indexing has created what might be a more permanently higher P/E ratio (price to earnings) for the S&P 500. That is, until it crashed next.

What I think we might take away from the indexer reality, higher valuations for longer and how the Federal Reserve manages things is that we might be in store not so much for a crash, as a very long choppy period in the S&P 500 starting from the next market top which I see in 2025.

What I mean is that because so many folks index, they are in effect buying the dips, offsetting any money that leaves the S&P 500 for greener pastures.

So, 10 year returns on the S&P 500 could be flattish from the next peak for potentially a decade. I understand “flattish” to mean “choppy” for several or more years ending in about the same place as it began.

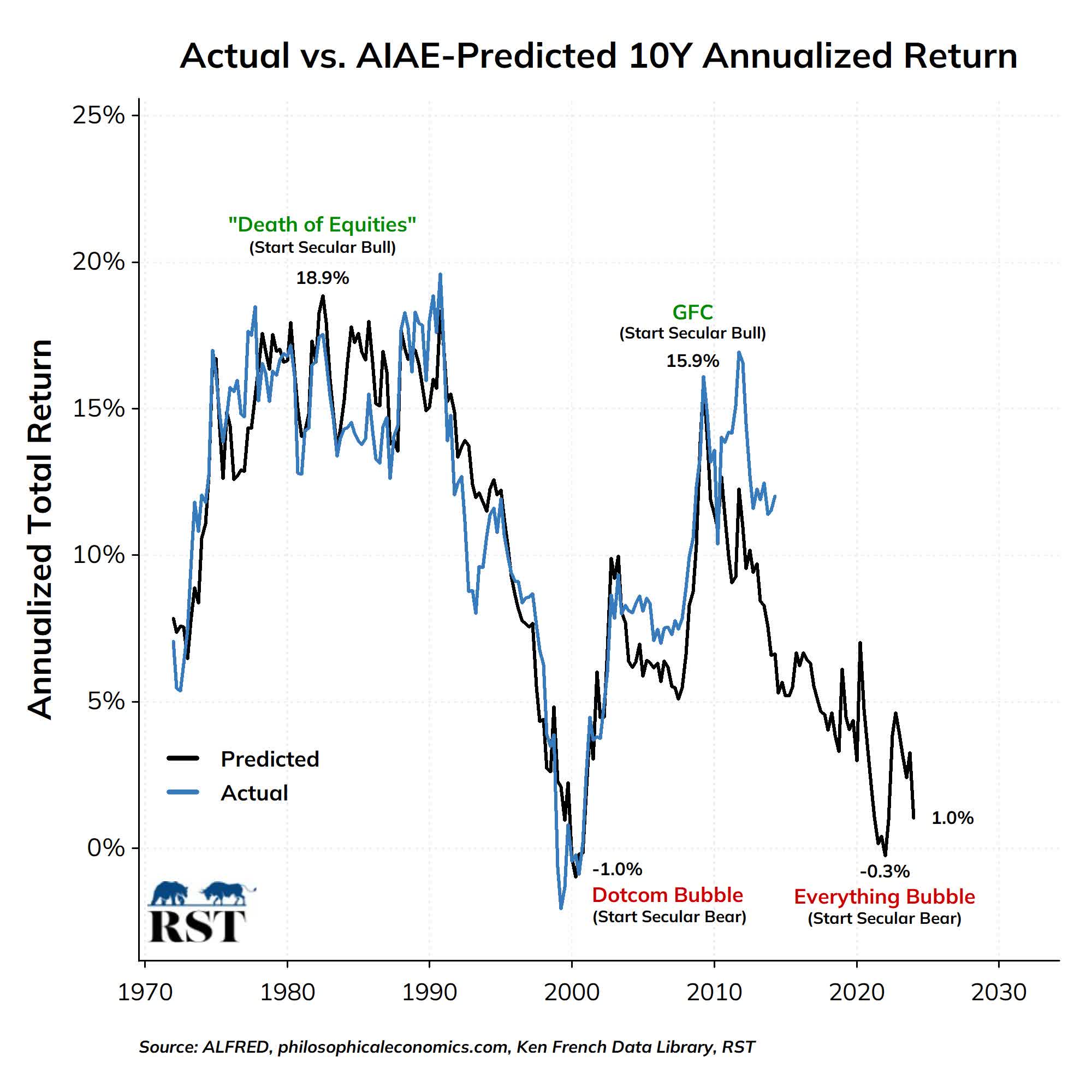

The AIAE (Aggregate Equity Allocation Index) which is similar to Tobin Q both expect low returns in equities to begin soon, in agreeance with my thoughts.

Small Caps Are Not In A Bubble

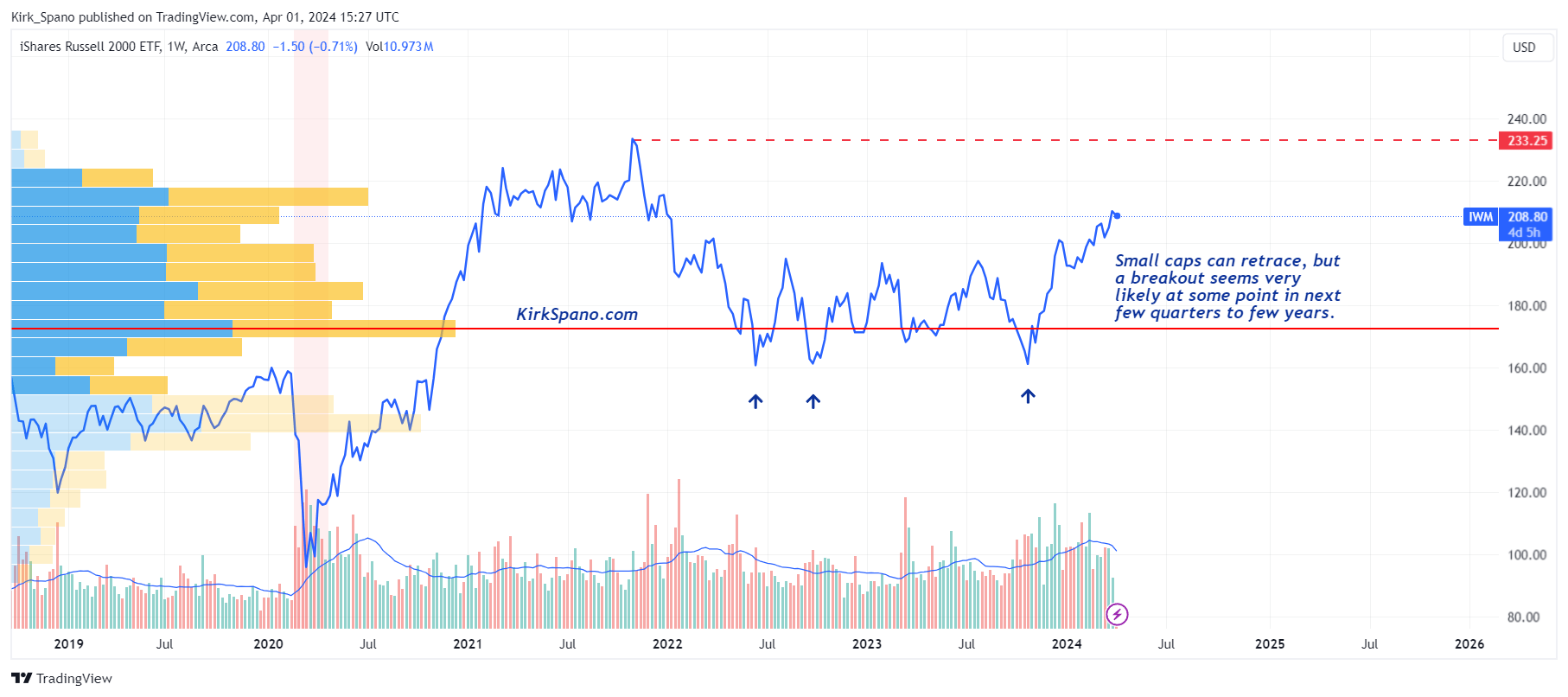

Right now is one of the largest disparities in small cap to large cap P/E ratios in history. That is, while large caps are flirting with extreme overvaluation on anymore rally, small caps are historically undervalued.

The Russell 2000 (IWM) has a median forward P/E a little below 11 right now while the S&P 500 is nearly 20. That’s a massive discount.

Tom Lee over at FundStrat has been discussing this for several months now. He sees a massive catch up for small caps coming. What makes that “catch up” for small caps likely to me are two things:

First, IWM has not set a new high since 2021.

I think in the current rally mode of the stock market, coupled with falling interest rates soon, that at least a retest of the 2021 highs is likely. From there, we’ll see.

The supporting fundamentals for at least some rally in small caps is that the growth rate on the Russell 2000 is about 600 to 700 basis points higher than the S&P 500. According to Lee, median sales for Russell 2000 stocks are growing at 6.9% vs S&P 500 stocks at 5.5%. EPS growth for Russell 2000 stocks are 18.6% vs S&P 500 at 11.8%.

The things to keep in mind are that the Russell stocks are often benefitting from the law of small numbers and that the S&P stocks generally have better balance sheets.

So, for me that does not mean jump into IWM, but, it does mean you can find small cap winners with some work.

A lot of the near term future for small caps are tied to whether or not we just faded a recession and are in fact double dipping a recovery phase. If so, then small caps have a lot of ramp to make up the PE disparity. Of course, if we have a recession, then small caps could retest the lows touched three time so far once again.

Longer term, I think small caps are still where Peter Lynch’s wisdom holds…

Big companies have small moves, small companies have big moves.”

Peter Lynch

While I am no IWM investor, I do like picking about a dozen risk managed small caps to my portfolio for potential huge gains.

Emerging Markets Are Not In A Bubble

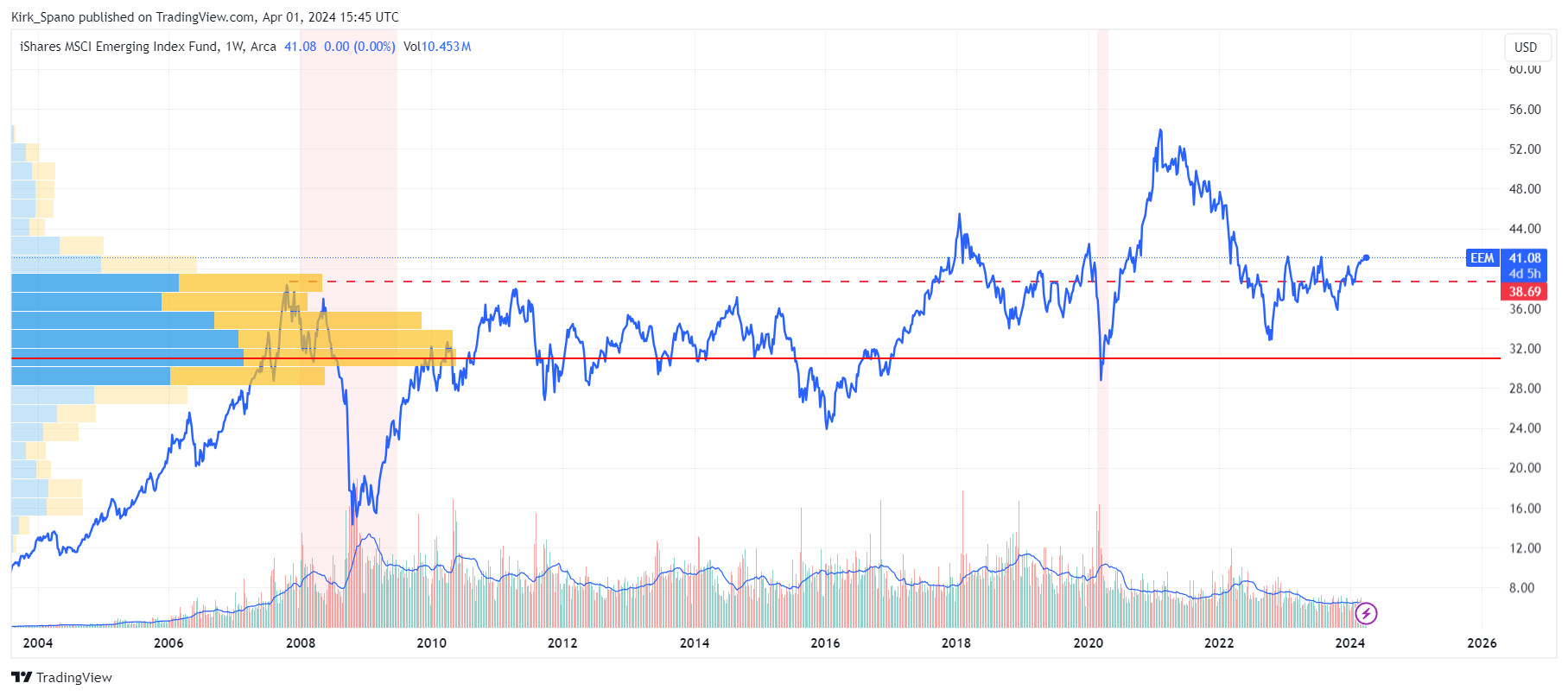

With the exception of the Covid rebound rally, emerging markets have been chopping around the highs set in 2007 for seventeen years now.

So, like small caps, the question becomes, breakdown or breakout?

Again, I think the answer is probably a retest of the 2021 highs, but maybe not a breakout past there. The discussion on what I see the rest of the decade will happen in future articles, but for the next year or two, I think emerging markets benefit from falling interest rates like small caps are likely to.

As of Q1 2024, the MSCI had a forward P/E of 11.85 which is almost exactly the average of 11.3. So, there’s nothing bubbly about that.

Interestingly, the cyclically adjusted 10-year P/E for emerging markets equities is about 15 versus about 27 for developed markets. That’s a hard valuation gap to rationalize when we take into account that emerging markets are growing faster and are seeing improving national balance sheets in many places.

For sure, emerging markets are a country by country, and region by region investment thesis. Like small caps, I do not buy the whole market indexes.

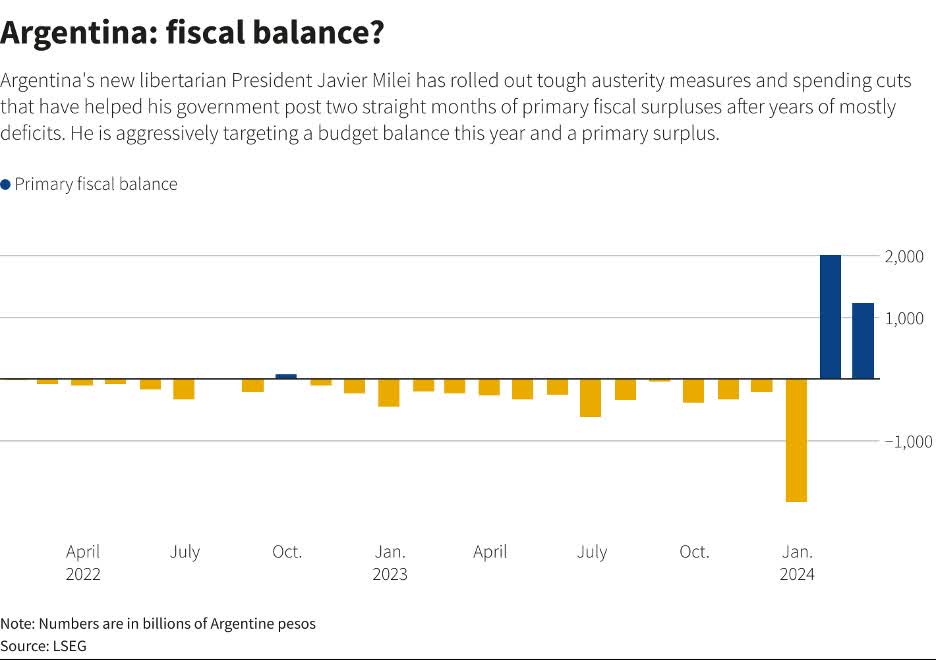

One place that is interesting to me in an investment world that mostly looks to Asia, is Latin America. I think we are seeing interesting things, in a positive way, happen there.

Suddenly, Argentina is fixing their balance sheet.

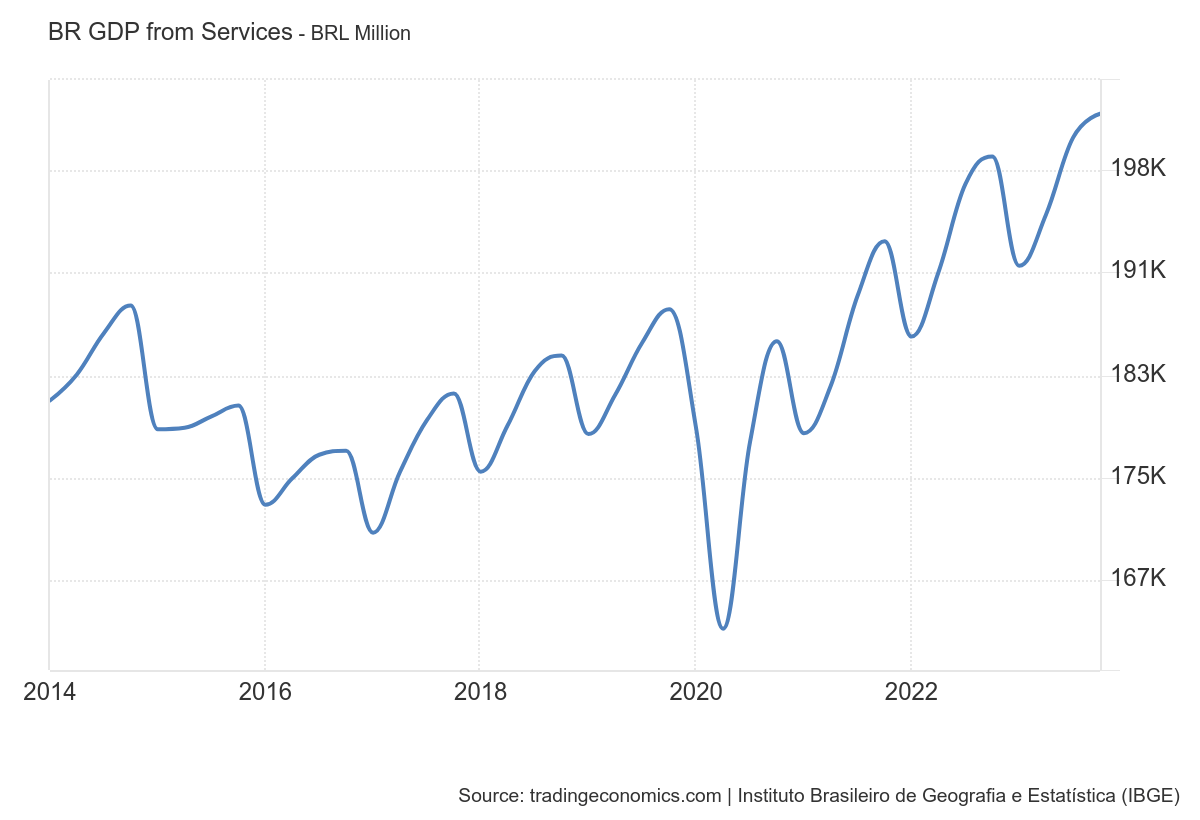

In Brazil we see services are growing at a good clip. This is a harbinger of an expanding middle class.

Broader we can look at the iShares Latin America 40 ETF (ILF) and see it too has been choppy for 17 years. This is an ETF that I added to 401k plans that I manage for companies last summer.

I think a broad analysis of Latin America can include 3 key positive factors:

- Proximity to the U.S. and its economic strength.

- Demand for resources from China and India.

- Significant lithium reserves for the clean energy secular trend.

While I do buy into the Asian and Indian growth stories, I think Latin America is overlooked and that could be changing soon.

Investing Closing Thoughts

In the short run, say the next year or two, the best U.S. investments appear to be in the broadening out of breadth to include small caps. Abroad, emerging markets seem ready to rally, but I am being selective regionally versus buying the broad baskets.

Over the intermediate term, say from about 2025 (when I think the next market top happens) to about 2030 (when when the last Baby Boomers get onto Medicare and most are on Social Security too), I think indexers will have a rough go of it. I’d expect them to get get low single digit total returns in line with AIAE projections.

And, a positive return for indexers only applies to those who don’t panic sell a correction. Folks who are emotional will likely end up with negative returns over 5 to 7 years, or maybe even a decade.

Long-term as usual, everything is getting better for quality of life, however, we do need to be cognizant of continued wealth aggregation by the richest 1% of the population. That sort of things foments dangerous nationalistic populism historically, which has historically opened the door to depression then war.

I’ll tackle some of the other bubbles in upcoming pieces.

Author

Kirk Spano

CEO/CIO — Fundamental Trends

Kirk is an Accredited Investment Advisor and founder of Fundamental Trends and Bluemound Asset Management LLC. Kirk has been highly successful in helping DIY investors make sense of the investment world, and profit in stocks, ETFs and crypto.